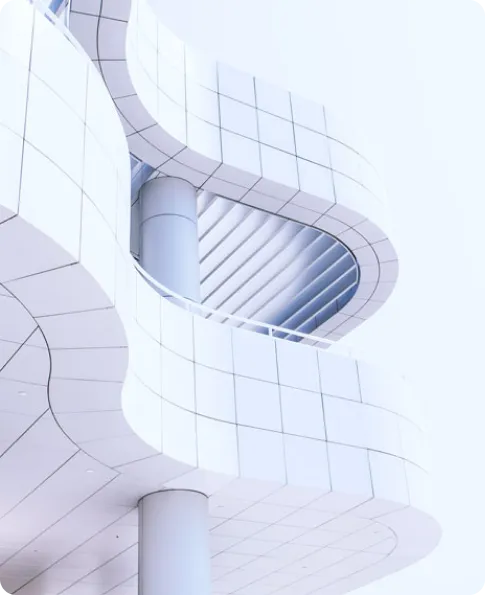

Navigate growth and compliance with ease

Integrating financial and management accounting across diverse financial instruments is an ongoing challenge, and ever-changing regulatory thresholds and rules demand a proactive financial approach to efficiently manage growth. Our platform helps you meet these challenges head on.

Highlighted solutions:

- Financial products subledger

- Financial control

- ESG

- Liquidity management

- Financial services data management