New corporate treasury expectations: are you ready to meet them?

3-minute read

Published on: 24 January 2025

Amid rising interest rates, persistent inflation, and banking-sector uncertainties, corporate treasurers have evolved with it into strategic advisors. They are now highly influential voices helping to shape an organization’s financial strategy and growth trajectory. In fact, research by PwC finds that only 16% of treasury roles are purely transactional.

Today, treasurers are busy trying to optimize cash efficiency, fortify balance sheets, enhance cash flow, and safeguard assets. And this requires a higher standard of service from their cash management provider. Is your corporate banking offering ready to keep up?

What do today’s treasurers need?

In an era of volatility, price pressures and increasingly complex business models, corporates need their cash to work for them – and that falls on treasury.

Key capabilities of the modern treasurer include:

1. Real-time cash visibility

Accurate decisions require up to date cash positions. That includes global visibility as well as integrated systems that connect bank data with ERP and treasury management systems.

2. Predictive insights and liquidity optimization

Managing risk through AI-driven tools to forecast cash flow and identify liquidity risks proactively, as well as actionable recommendations for fund allocation, debt repayment, or short-term investments.

3. Operational efficiency

More responsibilities mean more costs, which is why teams need the ability to streamline manual work such as reconciliation, as well as self-service their own account management needs.

4. Scalable, global systems

A globalized world means corporates need to be able to manage multi-jurisdictional, multi-currency accounts with a single, centralized system, with systems that suit their changing needs.

The corporate banking challenge

As part of the same pressures driving treasury change, corporates are also looking to upgrade their banking partnerships, with 40% planning to streamline partners by 2025.

Corporate banks who can adapt to the new demands of treasury have the chance to expand their market share over competitors and build stronger, value driven relationships. But this requires a significant shift in traditional cash management, moving from simply servicing needs to a proactive, advisory role that offers measurable value. And in today’s market, that means speed, insight, efficiency and connectivity.

To stay ahead, banks must modernize their infrastructure. They should use modular, cloud-based platforms that enable digital-first processes and work seamlessly with any core banking system. At the same time, banks also need to evaluate their legacy systems. They should decide on a clear transformation path—whether phased upgrades or a complete overhaul—to achieve the agility and scalability today’s competitive market demands.

How banks can stay relevant

Corporate needs will always be diverse and changing. That’s why corporate banks need to invest in agile, adaptable systems that can move with their customers. This starts with making information accessible, up to date, and integratable.

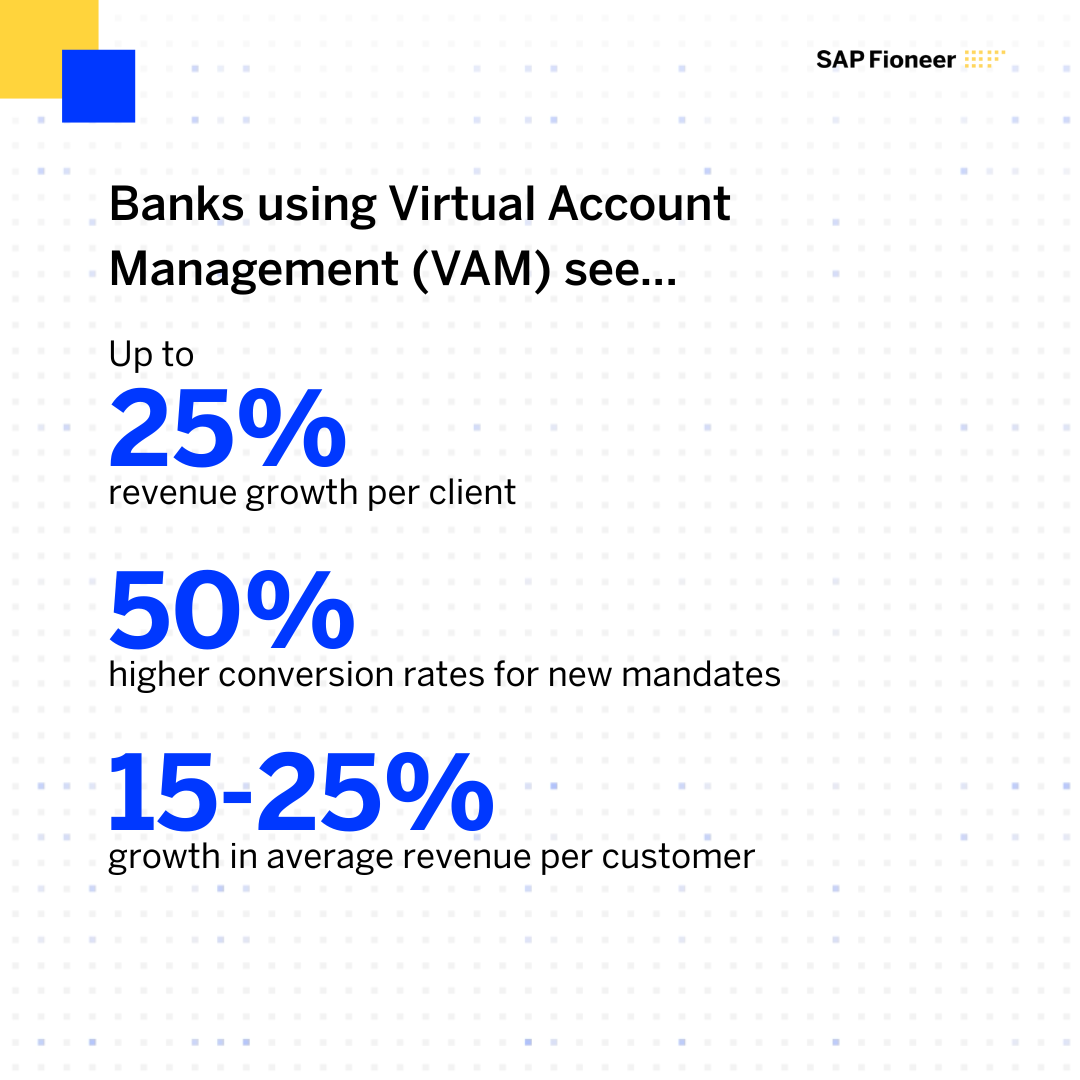

Solutions like Virtual Account Management (VAM) enable real-time insights, automation, and scalability.

- Virtual account management supports multi-entity structures, simplifies group cash management, and provides visibility across accounts, subsidiaries, or business units

- Moving beyond batch-based systems to a system of integrated data, dashboards and self-service capabilities. This enables treasurers to customize account structures, improve reconciliation, and maintain agility

- Supporting cross-border cash management with automated pooling, sweeping, and AI-driven cash forecasting for improved accuracy and control

Acting now to win tomorrow

In a data-driven future, corporate banks need to evolve with the clients, with a focus on treasurers’ needs for clarity, control, and agility. With systems that can deliver seamless data and insight, banks can build stronger relationships with their partners built on value and relevance. But now is the time to act.

With a streamlined implementation process, VAM enables cutting-edge cash management with AI-powered real-time visibility, automated reconciliation, and multi-entity liquidity management.

On-demand VAM video demo

Find out more about our advanced treasury solutions for corporate banking with our on-demand VAM video demo.

Related posts

Future-proofing your corporate bank: 7 signs your cash management solution needs an upgrade

The risk of staying stagnant: How corporate banks are stepping up in cash management with virtual account solutions

Unlocking efficiency: how technology is transforming corporate treasury functions

Most read posts

Navigating barriers and paving the way for GenAI in insurance

Virtual account management: the quick win for a stronger cash management proposition

The modernization dividend: Leveraging core insurance system upgrades for growth

More posts

Get up to speed with the latest insights and find the information you need to help you succeed.