- Home

- Finance and ESG

- ESG KPI Engine

Master ESG KPI management

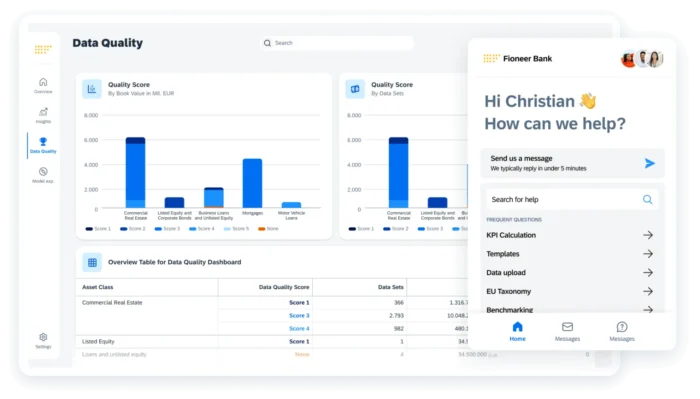

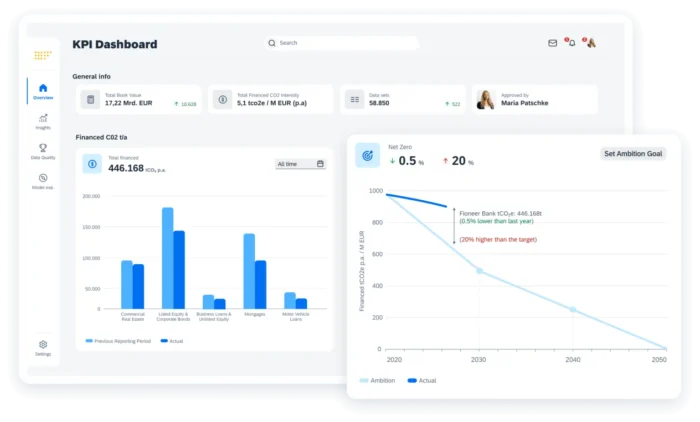

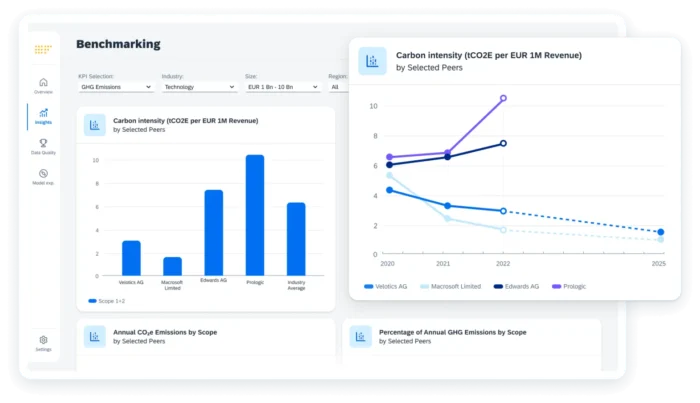

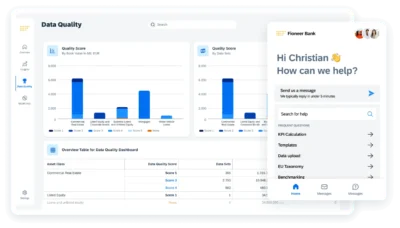

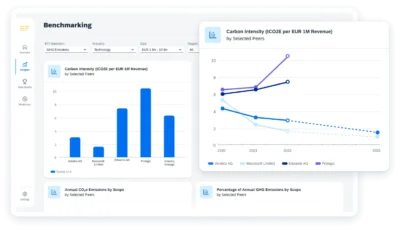

SAP Fioneer’s ESG KPI Engine provides a central solution to efficiently collect, review, calculate and store ESG-related single exposure and portfolio data – fast, immediate results anytime through the dashboard. Fully integrated with your architecture, our calculation module provides auditable standard calculations over your entire portfolio to enhance compliance and identify valuable transition opportunities.