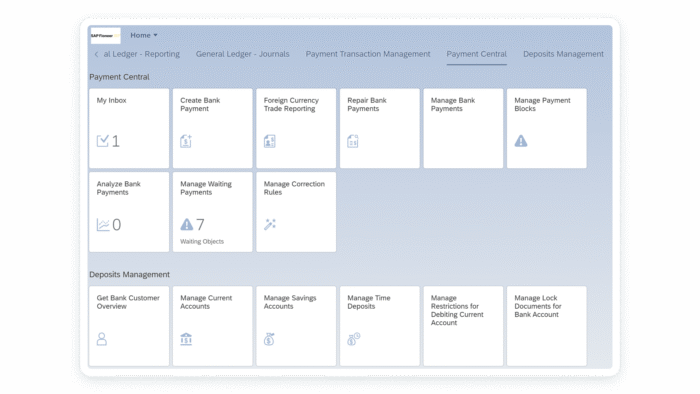

Centralize payments, stay compliant and scale confidently with Payment Central

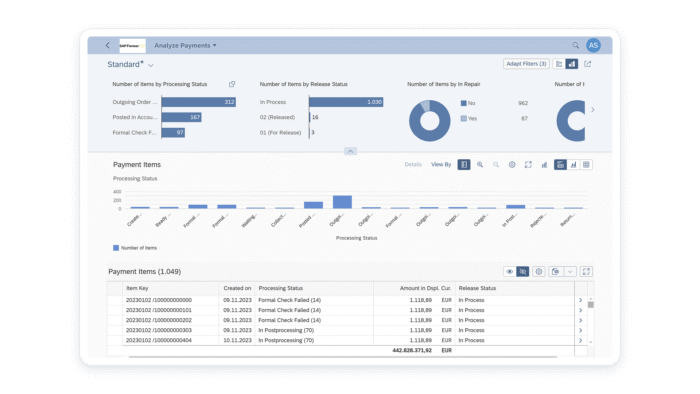

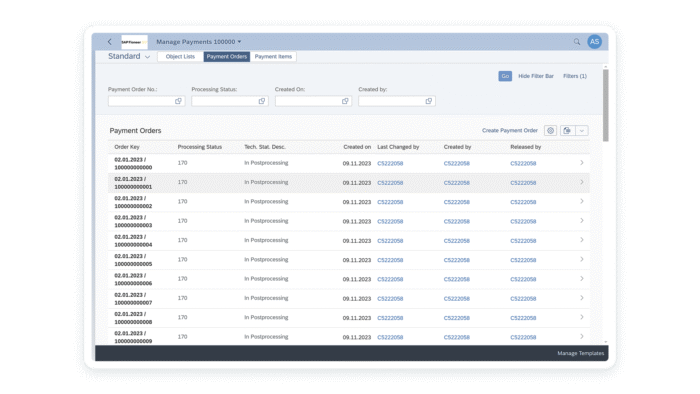

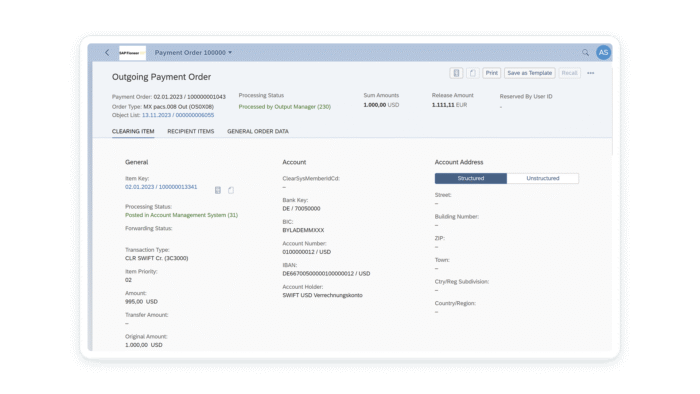

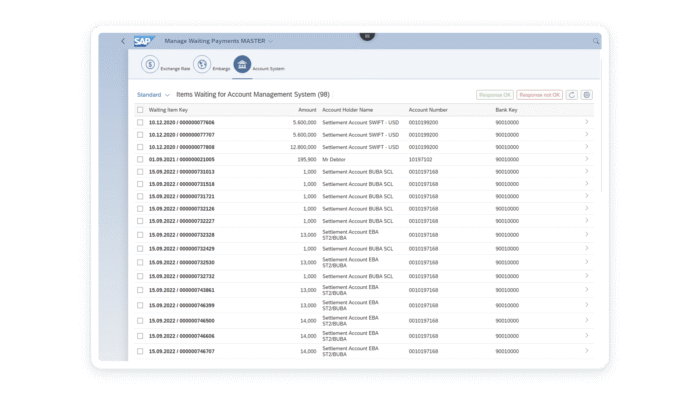

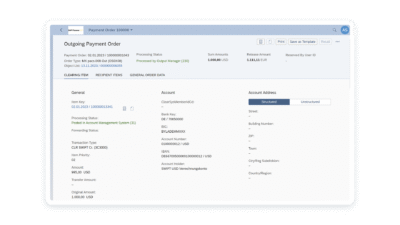

SAP Fioneer’s Payment Central modernizes payment infrastructure for banks, ready for tomorrow’s requirements. The single smart hub handles diverse, real-time, cross-border payment flows across multiple channels 24/7 – maximizing efficiency and consolidating operations for elastic scalability and powerful innovation.