- Home

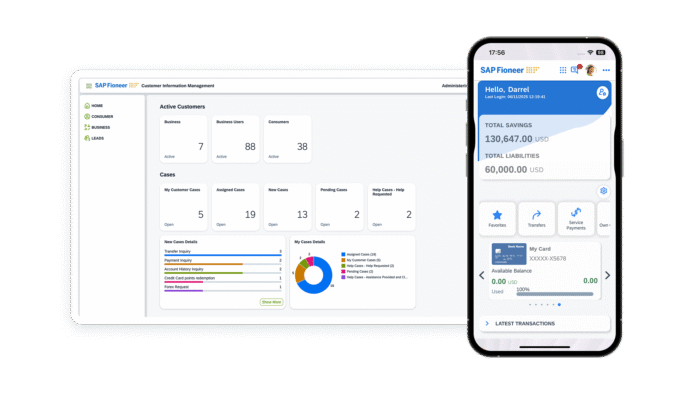

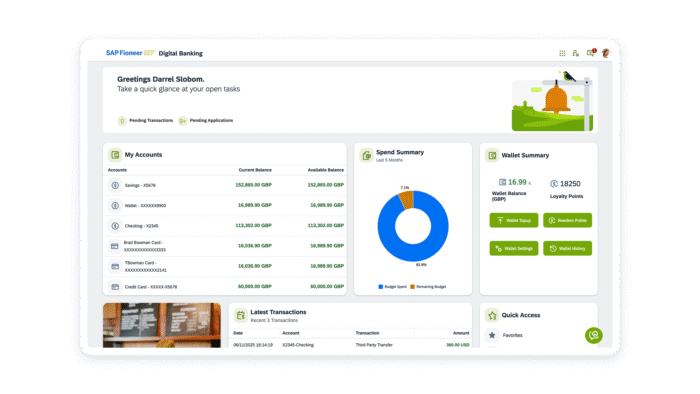

- Banking

Rock-solid core banking made for scale and speed

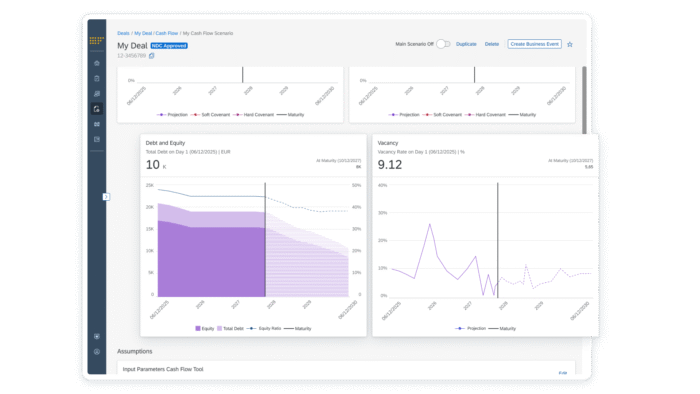

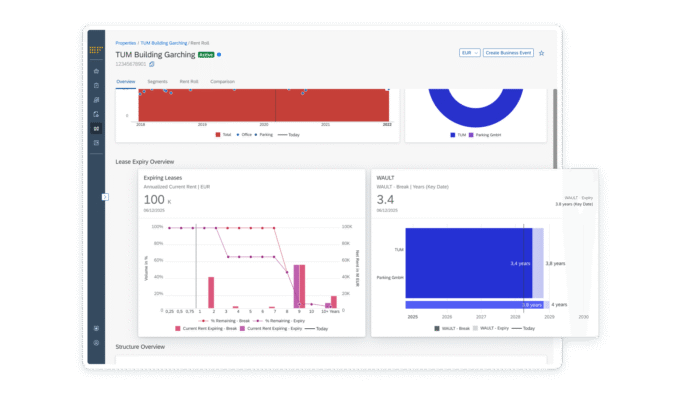

Get everything banks need to stay ahead of the curve in an ever-evolving market. Make the most of wide and deep lending, deposits and payments capabilities with multiple cloud deployment options. Enchance innovation with robust security and seamless UX.