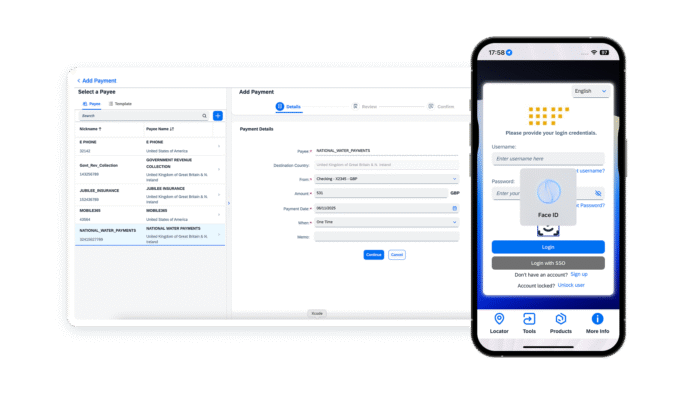

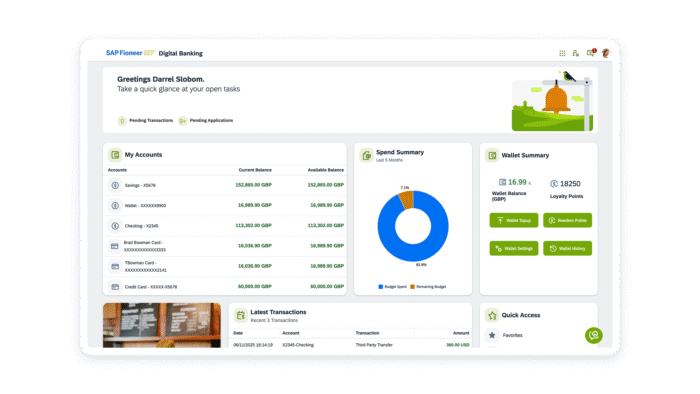

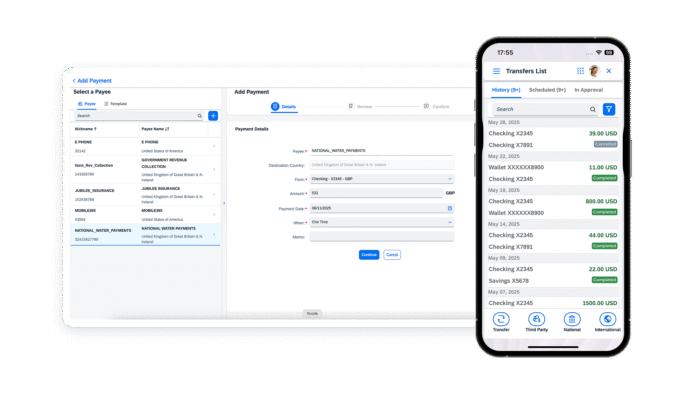

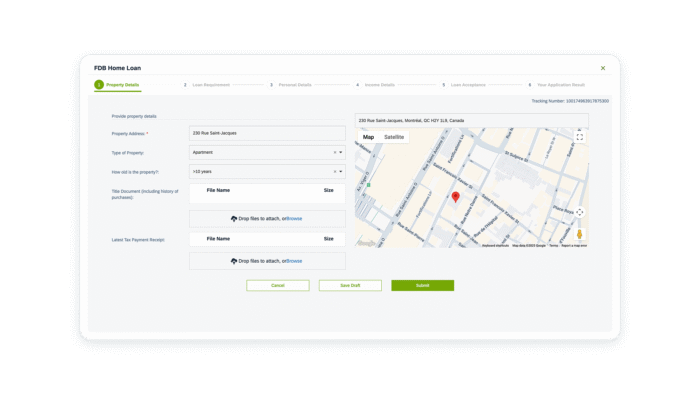

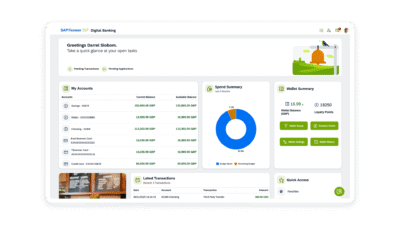

Empowering growing banks to create leading customer experiences

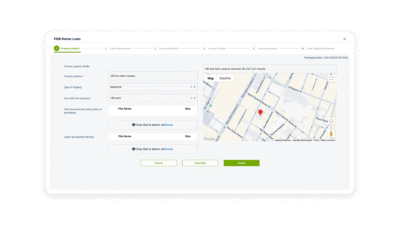

The Fioneer Digital Banking Suite – the next evolution of our Omnichannel Banking solution – enables growing banks to provide market-leading digital experiences and expand revenue streams with agility. Catering for retail, SME and corporate customers, it brings an extensive library of pre-configured functions, with business-level product configuration and AI-based personalization and automation. All of this on a modular, cloud-agnostic and integration-ready platform.