Revolutionizing financial services: The power of design thinking

7-minute read

Published on: 20 October 2023

Ask any financial business about its priorities, and you can bet improving the customer experience will be high up the list. We all know customer-centricity is critical – but understanding how to put it into practice is far less clear. In large, complex and regulated financial services businesses, customer-centricity is particularly hard to protect. It can be challenging to align with compliance requirements, and difficult to adapt legacy processes around. In financial businesses, customer-centricity won’t happen by accident. It has to be built in by design, and this is where design thinking comes into play.

Design thinking is a philosophy that ensures customers are at the very centre of product development from the outset. It starts by identifying and validating a problem, and then developing a solution in response. This might sound simple, but it’s radically different to the standard approach of building solutions around perceived problems, and applying them to use cases after the fact. Or worse – inventing products based on ideas, rather than innovating to solve real problems. Historically, some financial services businesses have had a tendency to build around business goals rather than customer problems. They prioritize regulatory requirements for their products, and retrofit the customer experience last.

But that standard approach is no longer fit for purpose – if it ever was. Fintech innovators that prioritize the customer experience are winning market share away from traditional financial services businesses, and forcing them to rethink their processes. Increased competition, new technology and changing customer expectations mean there’s a greater need than ever for design thinking inside financial services. Applied consistently and cross-functionally, design thinking elevates merely functional products to convenient, pleasurable and meaningful user experiences. Putting the customer, rather than the product first could drive better business outcomes, and the evolution of the entire sector.

It’s this philosophy that guides our product development process at SAP Fioneer. We’ve integrated design thinking across our business to ensure we only build solutions that customers truly care about. Here’s why we believe in the power of design thinking, and how we put it into practice.

The core principles of design thinking

The central tenet of design thinking is customer-centricity. A lot of businesses say the customer is at the heart of all they do, but at best, it’s a cultural principle. Design thinking turns it into a strategy. In design thinking, customer-centricity means thoroughly understanding and anticipating not only the customer’s needs, but their wants, likes, and preferences. Then, it means building solutions in response.

For design thinking to be prioritized in the product development process, it needs to be embedded across the whole organization. Every person within the business should know their customer’s context, perspective and expectations. This ensures the customer is truly at the centre of all product decisions, and helps create a more consistent experience across every touchpoint with the business. Aligning all products, services and experiences around the same verified customer intelligence gives businesses a better chance of satisfying customers, and creating loyalty in an increasingly competitive market.

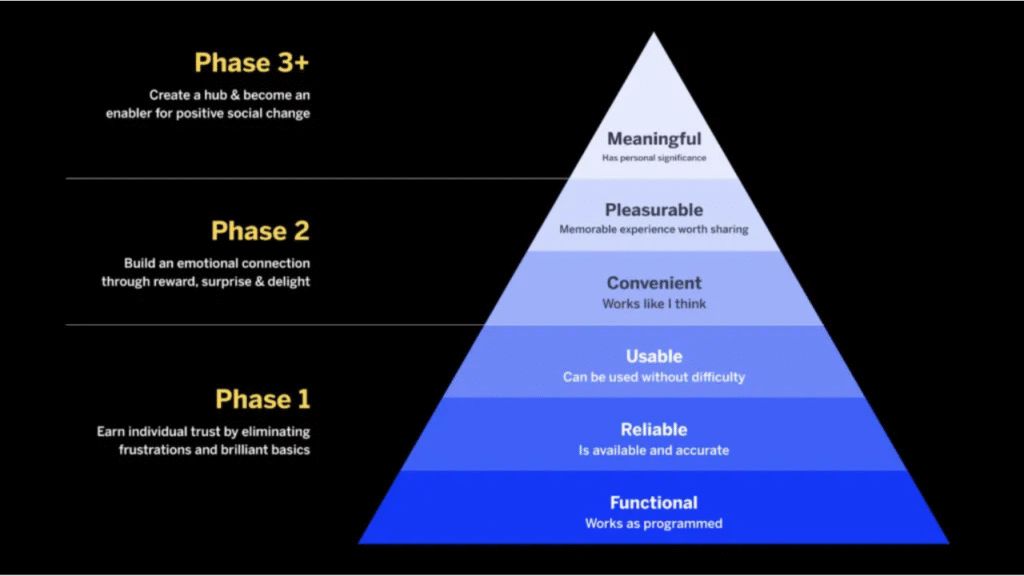

But what does a superior customer experience actually look like? There are three phases of customer experience, and cultivating customer-centricity helps businesses move up the hierarchy.

At Phase 1, products address the fundamental needs of the customer. They’re reliable and functional, avoid major friction points, and enable customers to achieve their objectives. The majority of products comfortably fulfil Phase 1 requirements.

Phase 2 is harder to achieve. At Phase 2, products deliver joyful, convenient, and pleasurable moments above and beyond core requirements.

Phase 3 is the ultimate goal of products built under a design thinking methodology. At Phase 3, product usage influences the customer’s behaviour and life, and drives meaningful change.

This could mean that an expert who no longer has to spend time on manual tasks can work on interpreting data and informing management decisions and with that develop professionally.

Applying design thinking inside financial services

Moving up the customer-centricity hierarchy is hard for any organization, as it requires people to restructure the processes and continually repeat to find the best-possible iteration of the product. But it’s particularly challenging inside financial businesses, where the natural desire for customer-centricity is in competition with regulatory requirements and ingrained, often siloed ways of working.

Where many financial businesses struggle is that customer-centricity inevitably comes second to compliance. Rigorous compliance processes can be cumbersome and add significant friction for customers; integrating them into a delightful customer experience is a difficult balance to strike. There are other challenges, too. Legacy financial businesses can be slow to innovate thanks to large organization structure and heavyweight technology. Drastically remodelling something as fundamental as product design requires strategic change management, and the buy-in of stakeholders across the organization – many of whom may be resistant to adapting familiar and time-honoured ways of working.

It’s for these reasons that so many financial services products only fulfil Phase 1 of the customer-centricity hierarchy. But products that are merely functional are no longer enough to attract and retain financial services customers, whose expectations have changed dramatically since the onset of the fintech revolution. Increasingly, financial services is trending towards greater segmentation and personalisation, leaving functionality and reliability as little more than hygiene factors – not market-winning differentiators. For financial products to stand apart, they need to do more.

How we deploy design thinking at SAP Fioneer

Ideally, financial services products should leverage the basic user experience established in Phase 1, and build upwards to reach Phase 3. Starting from a foundation of earned trust, brilliant basics and a frustration-free experience, product teams should test and iterate to discover the moments that create emotional connections through reward, surprise and delight.

Design thinking enables this approach, and despite the undoubted challenges, can be applied effectively inside even the most traditional, complex and highly-regulated businesses. It’s a common misconception that design thinking doesn’t belong in B2B contexts. But there’s an end-user behind every piece of software. Whether it’s the customer, or the customer’s customer, the designer needs to consider that end-user at every step of the development process to deliver the best outcomes. We know this because we’ve tried and tested it at SAP Fioneer. We’ve baked design thinking principles to our product development process, and it’s helped us elevate our innovations to Phase 2. By continuing to iterate and leverage design thinking, we’re confident we can find ways to add even more value for our customers. Here’s how we do it:

We co-create with our customers:

We engage customers as active participants in the iterative design process, collaborating with them from a very early stage on to gather insights, generate ideas, and test prototypes. This approach ensures we meet their needs, fostering ownership and investment for the tailored product.

We make decisions evidence-based:

We rely on empirical evidence, not assumptions or intuition, to make design decisions. Our decisions are informed by data from user research and testing. This results in more effective products that better serve our users.

We work with prototypes (communication, validation, exploration):

We use prototypes to validate our ideas and assumptions with users. Then we communicate and test our designs with stakeholders, exploring and iterating on different design ideas.

At SAP Fioneer, we think design thinking has the power to revolutionize financial services, and build the next generation of customer experiences. As the industry evolves, customer-centricity is critical for financial services businesses to win, retain and grow their market share. Putting customers at the heart of the product development process is not only nice to have, but a necessity. And it’s made possible by embedding design thinking principles. Design thinking empowers even the most highly-regulated and complex B2B businesses to build better, and ensure that the customer really does come first.

To know more about how we develop innovative products using design thinking at SAP Fioneer reach out to our team!

Related posts

How Banking as a Service is leveling the playing field for international banking

New corporate treasury expectations: are you ready to meet them?

Future-proofing your corporate bank: 7 signs your cash management solution needs an upgrade

Most read posts

The modernization dividend: Leveraging core insurance system upgrades for growth

Navigating barriers and paving the way for GenAI in insurance

Virtual account management: the quick win for a stronger cash management proposition

More posts

Get up to speed with the latest insights and find the information you need to help you succeed.