The four pillars of a future-fit core banking strategy

5-minute read

Published on: 17 November 2022

Over the last decade, core banking has changed immeasurably. Challenger banks and new fintechs have rapidly accelerated this shift. Now, incumbent banks face competition from outside of finance too — this competition is coming from big tech players armed with deep pockets and loyal audiences.

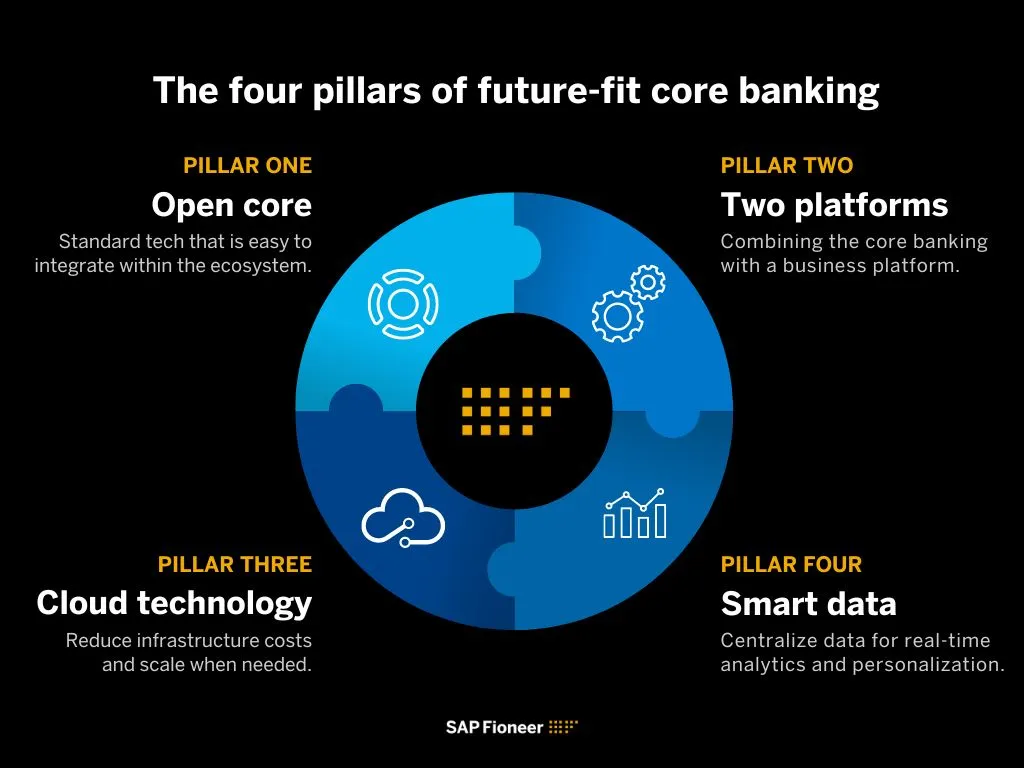

At SAP Fioneer, we’ve developed a four pillar core banking strategy designed to help financial institutions keep pace with rising challenges. In this blog, we’ll explore each pillar and show how banks can apply them to drive innovation and stand out.

What’s driving this change?

Customers expect more. They want innovative, easy-to-use products and seamless experiences across digital and traditional channels in real-time. They don’t want to just access their accounts. They want a full ecosystem of personalized financial products. This applies to both retail banking and businesses alike. Personalized ecosystems provide a huge competitive advantage to providers who can offer their corporate clients efficient, self-service systems gain a clear advantage.

But meeting these expectations requires an open and flexible banking core. One that integrates easily with internal and external services via APIs. With open architecture, banks can quickly launch and scale new core capabilities without disrupting existing functionalities.

Some forward-thinking financial institutions are already doing this. However, many banks are held back by rigid legacy systems. These are often complex, costly, poorly optimized and slow to adapt to new technologies.

Modernizing these systems is essential to stay competitive.

The four pillars of a modern core banking strategy

Banks must strike a delicate balance between innovation and reliability. They need to meet increasing customer demands and expectations and match the agility of challengers and big tech. All while remaining a trusted partner with performance and stability.

This calls for a modern but reliable core banking system. One that is robust, flexible and future-proof.

Our four-pillar strategy is built on our own deep banking and technology expertise.

Pillar 1: An open and modular core

Future-ready core banking systems need to support a reusable, standardized set of products and processes. This means being ready for ever-evolving innovation and extensions.

This means replacing customer interfaces and replacing them with APIs and custom code with standard functionality. The result? Greater agility and flexibility to deliver new capabilities fast. Banks can also tap into third-party plug-and-play services to enable the ecosystems modern customers desire.

The benefits are clear. Banks that adopt this method are already seeing success. Of the financial services organizations already using APIs:

- 58% reported increased productivity

- 48% reported increased innovation

Pillar 2: A two-platform approach

Agility is a key differentiator for banks. That’s why our second pillar focuses on a two-platform approach for overall core architecture — complementing a core banking platform with a separate business solutions platform.

The business platform

We propose a cloud-based platform for business functionalities that connects to the core. It’s provider-agnostic and works with any hyperscaler such as GCP, AWS or Azure. This avoids vendor lock-in.

Banks can use it to rapidly create customer-focused, cloud-native business processes. These run independently from the core without impacting operations. Banks can also integrate third-party services into the business platform, helping them build out their ecosystems.

The digital core platform

Tier 1 banks hold millions of accounts and process thousands of transactions every second, while simultaneously striving for continuous innovation.

That’s where the second, ‘digital core’ platform comes in. It connects to business applications via published, RESTful domain APIs. This ensures performance, security and reliability of the core. It also allows banks to adopt innovation from the core vendor without disrupting their business.

Pillar 3: Cloud enablement

Cloud migration cuts infrastructure storage and maintenance costs. It also eliminates wasted capacity during off-peak times. Instead, banks can scale up or down as needed and only get charged on actual usage rather than capacity.

Plus, moving away from basement servers enhances the pace of innovation. Core updates from vendors can be deployed without disruption to day-to-day operations.

The numbers back this up. According to Accenture, large banks that have moved to the cloud experienced:

- 10-20% cut in operational costs

- 30-50% shorter time to market

- 40-50% quicker provisioning speed.

Pillar 4: Smart data and analytics

To deliver hyper-personalized, omnichannel products, banks need a unified customer view. Centralizing data not only improves data quality and reduces data footprint; it also enables AI and ML use cases.

But this all requires a core built on a database fit for purpose. One that captures and stores and centralized data and makes it available in real-time.

That’s why our core banking system is built on SAP S/4HANA. Its in-memory database combines transactional and analytical data, providing banks with a real-time, 360-degree customer view. This opens up use cases like real-time cash flow analysis and predictive “next best offer” recommendations.

With built-in AI and ML, it also automates back-office processes, cutting costs and freeing up staff to focus on more complex tasks.

The SAP Fioneer difference

A future-fit core banking system starts with these four pillars.

But successfully executing this strategy requires more than technology. It takes internal alignment, a clear roadmap and a shift in the traditional, cautious culture of core banking.

That’s where we can help.

We care as much about relationships and strategy as we do about software and engineering. We understand that core banking modernization can feel daunting. But we’re ready to help banks tackle these challenges and get the very best out of the right solution.

Want to learn more?

Download our core banking whitepaper to learn more about the trends in global banking and dive deeper into these four pillars.

Related posts

How to transform core banking for the digital age

Most read posts

Virtual account management: the quick win for a stronger cash management proposition

Navigating barriers and paving the way for GenAI in insurance

The modernization dividend: Leveraging core insurance system upgrades for growth

More posts

Get up to speed with the latest insights and find the information you need to help you succeed.