Three ways to make B2B software solutions more user-friendly

5-minute read

Published on: 26 March 2024

For a long time, user experience (UX) has been little more than an afterthought in the B2B financial services space. Now, that’s starting to change. Financial businesses are recognizing that when it comes to enterprise software, a delightful UX is not just nice to have: it’s a critical competitive differentiator, and a powerful driver of growth.

B2B software has a bad reputation

The value of UX is already well-understood in the B2C space, where solutions have developed rapidly in response to maturing end-user expectations. But it’s been more or less overlooked in the B2B space. That’s partly because end-users – the C in B2B2C – simply don’t see it. Investing in the design of behind-the-scenes tools hasn’t been considered worthwhile – the prevailing attitude has been that as long as they get the job done, it doesn’t matter how their experiences are, or how much they delight business users.

This way of thinking has been even more pronounced in the world of financial services solutions. In such a highly-regulated industry, usability, significance and joy of use have – understandably – been far less of a concern than compliance and functionality. Ease of onboarding and efficiency gains have been way down the list of assessment criteria, if they’ve been taken into consideration at all. Often, they haven’t: decision makers are rarely the people using it, so their decision criteria are limited to their own objectives, e.g. budget or functional scope. The result is that most users of enterprise applications don’t have a choice about using them – and they just accept how it is and how it works as this is the only given choice for them. This is in stark contrast to consumer applications, where there’s usually a large choice of products, and UX can make the difference between users staying loyal, or switching to a competitor.

But financial services has changed dramatically in the last few years, and that change is now being reflected in the way B2B solutions are being built. Businesses understand that their people are users too, and their maturity digital experiences has changed. The success of tools like Slack, Monday or Asana has shown that design matters. Its ease of use and intuitive onboarding has made it the go-to internal messaging and project management tool and set a high bar for enterprise software. B2B solutions that look outdated and difficult to use no longer have a place inside businesses that are focused on growth. As understanding of the value of UX design matures, the B2B financial services industry is transitioning away from product-centricity and towards human-centricity. Businesses know that it’s no longer enough to just do the right thing; they also have to do it in the right way.

UX design improves business outcomes

Demand for well-designed software is growing, and those that cater to what their team wants will reap the rewards. Users are the biggest promoters of products, and designing solutions around their needs to create experiences that are joyful, fast, efficient and effective can dramatically improve business outcomes.

Tools that are not designed with a focus on UX will still ‘get the job done’, But when UX is designed around user pain points, it has a direct impact on critical business outcomes. Key UX metrics like task success rate, time on task, user confidence and task error rate all roll up into operational KPIs like operational efficiency and resource utilization, and the success of the business at large.

Not only does UX empower teams to perform better, it also creates cost savings. Failing to prioritise usability and usefulness is therefore a missed opportunity to drive business growth. Clare-Marie Karat, a principal UX consultant and former IBM researcher, says that businesses should invest in UX as early as they possibly can: “A rule of thumb is for every one dollar invested in User Experience research you save $10 in development and $100 in post-release maintenance.”

What to look out for

Finding the right solutions might now look like a complex task. But there are three key details software buyers and those consulting the decision makers should keep in mind when evaluating solutions to ensure they’re making the right tools available to their team:

1. Efficient User Flows

Users need a seamless workflow to navigate through complex data and generate insights without unnecessary friction.

One example might be streamlining the process for financial analysts to input and analyse data within a business intelligence platform, ensuring a logical sequence from data input to generating comprehensive reports.

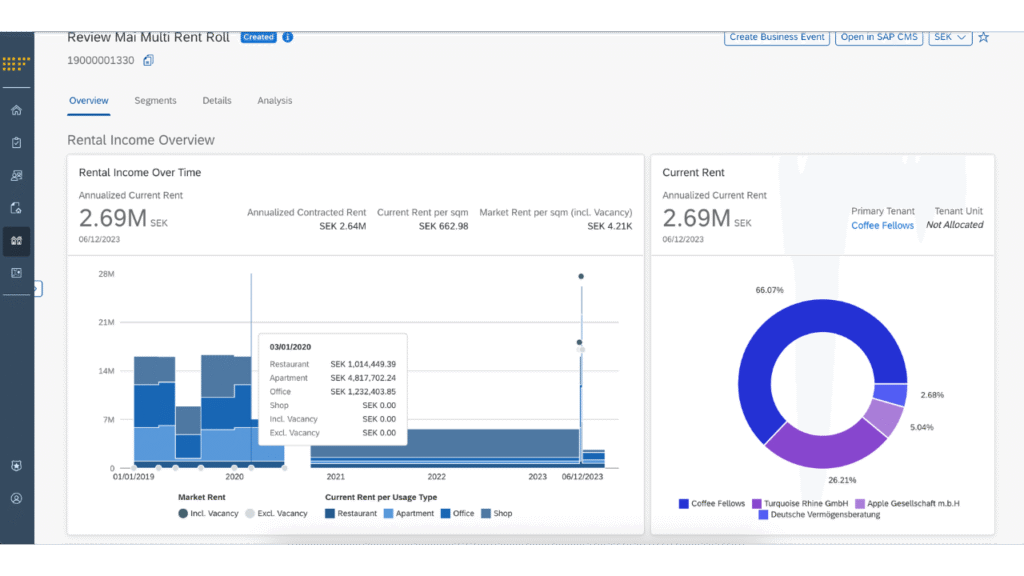

2. Engaging Microinteractions

Adding interactivity and responsiveness to the interface elevates the overall user experience. Microinteractions make software more interactive and responsive, increasing satisfaction and the likelihood teams will continue to use it.

Complex financial dashboards can benefit from thoughtful microinteractions. Implementing interactive data visualisations, where users can hover over specific data points to reveal additional insights, trends, or contextual information, helps analysts gain deeper understanding without overwhelming the interface.

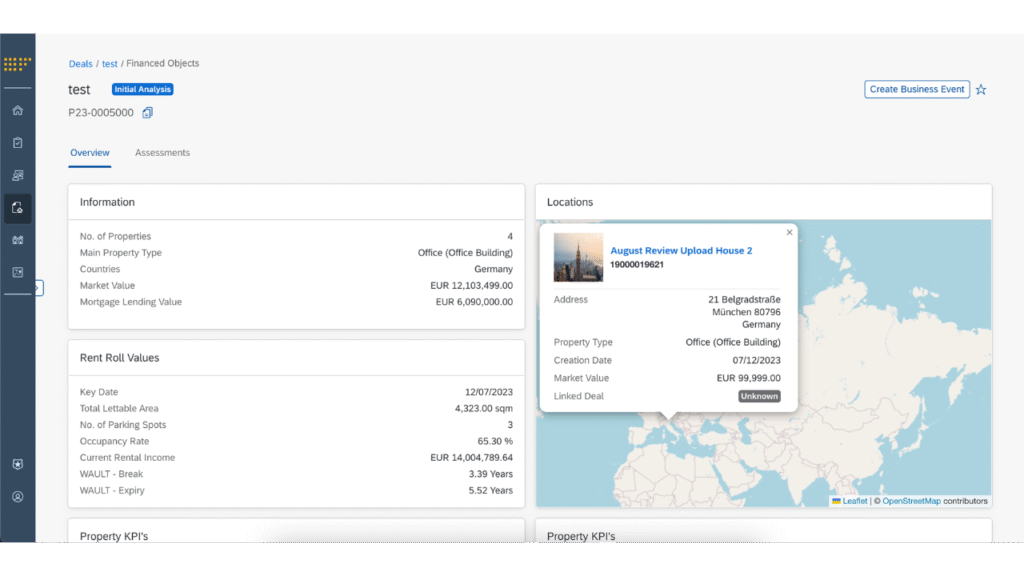

3. Context Sensitivity

Tailoring the experience based on the specific context or task at hand ensures that the interface responds intelligently to user actions, providing relevant information and options.

This could mean dynamically showcasing key performance indicators relevant to the user’s role within a financial analytics tool.

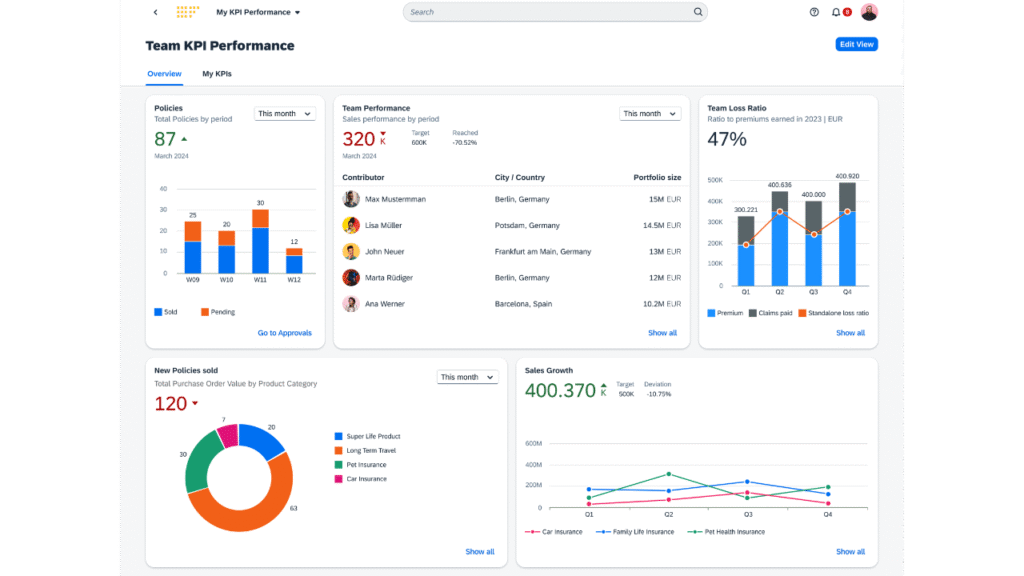

SAP Fioneer designs user-friendly solutions

Baking UX in from the outset of product development can improve business outcomes by increasing the value and potential virality of products, and preventing expensive redevelopment later on.

At SAP Fioneer, we mitigate the risk of product failure by building solutions around user pain points. We conduct thorough research and testing to ensure that users – and their pains, gains and jobs-to-be-done – are at the centre of product development from the start. We create prototypes as a means to iterate on solutions, and communicate with stakeholders to drive effective, collaborative decision-making. We’re committed to continuous enhancement of user experience, and the result is more effective products that improve productivity and empower users.

To learn more about how we create user-friendly business solutions for financial services, get in touch.

Most read posts

Virtual account management: the quick win for a stronger cash management proposition

Navigating barriers and paving the way for GenAI in insurance

The modernization dividend: Leveraging core insurance system upgrades for growth

More posts

Get up to speed with the latest insights and find the information you need to help you succeed.