How embedded finance is reinventing Total Working Capital Management

6-minute read

Published on: 11 April 2023

Managing working capital is one of the most crucial functions for a finance team, ensuring the business has sufficient liquidity by optimizing assets and liabilities to enable day-to-day operations. However, for large corporates managing thousands of transactions daily across multiple systems, as well as complex inventory, ordering and credit positions, this can be a complex and time-consuming task. Stephen Skrobala, who leads Banking and Capital Markets advisory at SAP Fioneer, shares with us a new approach to making this process more efficient.

Part of the reason for this complexity is the large numbers of systems and data sets involved in tracking business activity at a broad level. Not only does this harm the ability of corporates to manage their cash cycle and runway at scale, but it also limits the scope for banks to support clients proactively with cash-management services that meet the needs of an increasingly dynamic and volatile commercial environment.

However, embedded finance presents an opportunity for a paradigm shift. By integrating banking services with other core systems, such as ERP or supply chain management platforms, banks can offer deep-tier financing, enabling more businesses in their customers’ networks to seek investment or credit opportunities in line with their cash position.

This opens the door to a new approach: Total Working Capital Management (TWCM). TWCM involves identifying and directing all the organizational processes and values that influence and drive working capital, beyond the traditional realm of cash, accounts payable (AP) and accounts receivable (AR). By facilitating and directing these systems, banks can build closer working relationships with customers, helping them solve liquidity issues proactively while also creating new revenue opportunities for cash management and credit services.

Excited to tap into the opportunities in B2B embedded finance? Join us on our webinar on the 20th of June where we discuss the megatrends in B2B embedded finance, the key enablers to make it a reality and show you a real-life demo of use cases. Secure your spot here!

What are the total working capital management issues facing corporate customers?

With the proliferation of digital business management systems, global supply chains and changing regulatory pressures, corporates often find themselves with large, unwieldy technology stacks and huge volumes of data. Sourcing, analyzing and updating a clear picture of the business’s liquidity position requires extensive manual work, sorting and review, leading to increased risk of unrealized stock liabilities or runway issues due to:

- Limited customer Insight: The time it takes to on-board a client slows the corporate’s ability to do business and the bank’s ability to earn revenue due to disconnected data processes and legacy systems.

- Inventory risk: Supply chain issues and costs are making companies take a critical look at their procurement processes and inventory management. Highly manual finance processes for managing credit and payments exacerbate existing risk from unreliable suppliers, shelf life, theft, loss, damage, and life cycle that lead to inaccurate forecasts that affect cash flows.

- Credit and Liquidity: Supply chain complexity and tightening rules on capital ultimately force banks to limit credit availability or assess higher rates of interest to cover the capital charge due to limited visibility across customer networks.

In the face of these challenges, corporates need additional support from their banking partners, but this requires a new approach to systems, data and services.

Adapting systems for total working capital management

Currently, relationships between banks and their corporate customers are limited by the scope of the systems that connect them. The majority of institutions focus on cash – since this is the area over which they have direct visibility – but embedded finance provides the chance to unlock new opportunities by extending their reach within the existing clients’ ecosystem and across all finance functions that impact and influence working capital.

As an example, banks can embed their financial offerings within the inventory, sales, procurement or contracting processes of their client’s organizations, creating opportunities to offer additional advice, services and brokering opportunities to solve the issues clients face day-to-day.

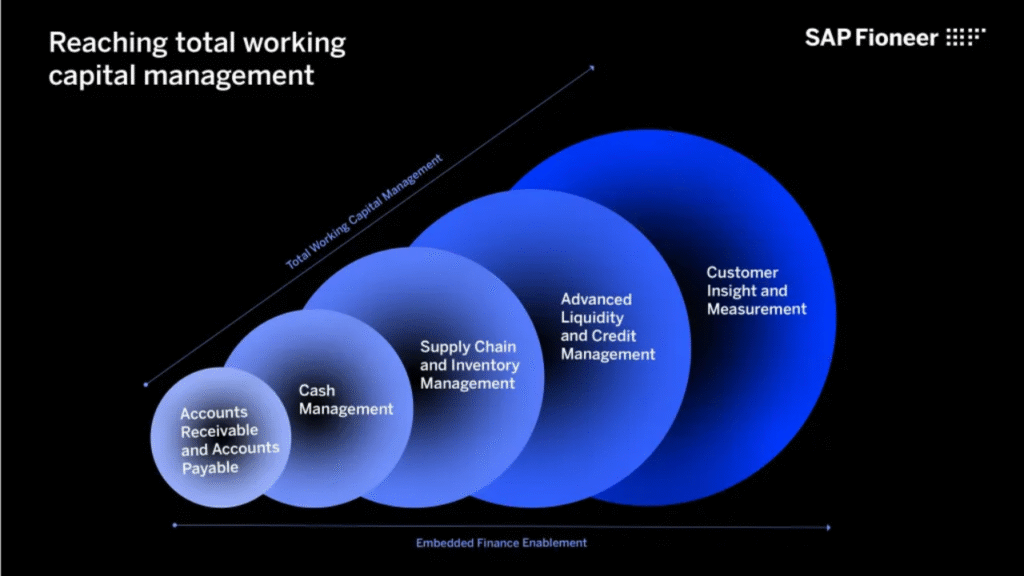

This requires a holistic view of all working capital relevant asset and liability classes, starting from the traditional baseline of AP/AR and expanding into historically hidden areas of visibility, such as supply chains and sustainability commitments, as in the diagram below:

This enables a progressive increase in the value that banks can provide for their customers:

- Improving the Accounts Receivable (AR) and Accounts Payable (AP) process to allow companies to understand the timing of the inflows and outlays.

- Integrating the treasury function improves the speed at which cash is utilized.

- Understanding inventory to add context through better forecasting of AP and AR with better options for short-term treasury activity.

Driving value with embedded finance

As well as creating better visibility and control for finance teams, embedded finance creates new opportunities for banks to offer and expand existing services and create new products to support clients in their TWCM goals.

The scope for value creation is limited only by the level of implementation and the commercial strategy of the institution, with key use cases including:

- Deep network financing: Offering credit services within and between client ecosystems to support holistic growth, assessing partner risk using existing client data.

- Proactive credit management: With contract and ERP visibility, banks can offer services such as Invoice and Inventory Finance before the business reaches a critical position, with terms to the client’s needs.

- Integrated investment delivery: Offering connected treasury options for clients to manage short-term cash opportunities through securities or bonds through a single interface.

- Inter-customer TWCM: Connecting clients with complimentary needs, such as an excess of inventory, to facilitate transactions that support improved liquidity for both parties.

In expanding their range of services, banks can not only improve revenue, but also enhance customer retention by providing unique services only accessible through their platforms that directly improve customers’ financial health.

Embracing TWCM for your customers

As the corporate banking market becomes increasingly competitive, institutions need to find new ways to engage, retain and monetize their business customers by focusing on their clients’ most important needs.

Embedded finance offers the chance to simplify corporate treasury operations by implementing financial tools within client’s businesses that connect, track and aggregate functions in real time. This, in turn, improves the working capital function while also unlocking new revenue streams for corporate banks. Embedded Finance from SAP Fioneer can be used in a variety of Treasury and Finance scenarios, integrating with a range of core systems to help banks provide value beyond traditional capital management, including inventory, investment, business intelligence and forecasting.

To find out more about how embedded finance is creating new value-creation opportunities for banks and their clients, join our webinar on the 20th June where you can see a live demo of use cases with Vishal Shah, Head of Embedded Finance and Dr. Natascha Bell, Senior Solutions Manager. Secure your spot now here!

Stephen Skrobala leads Banking and Capital Markets advisory at SAP Fioneer, leveraging experience at JPMorgan Chase and ABN Amro, where he had management and client-focused roles in outsourcing, product management, commercial account management, and consumer banking. He degrees include Villanova School of Business and an MBA from Fordham University. Reach out to him on LinkedIn or at [email protected].

Related posts

Fast, open finance and a new world of risk management part 2: Embedded finance and how businesses can stay protected

Embedded finance and SME banking: a winning strategy

Beyond B2C: How embedded finance is shaking up B2B

Most read posts

Virtual account management: the quick win for a stronger cash management proposition

Navigating barriers and paving the way for GenAI in insurance

The modernization dividend: Leveraging core insurance system upgrades for growth

More posts

Get up to speed with the latest insights and find the information you need to help you succeed.