How to achieve sustainable growth in SME banking

9-minute read

Published on: 22 June 2023

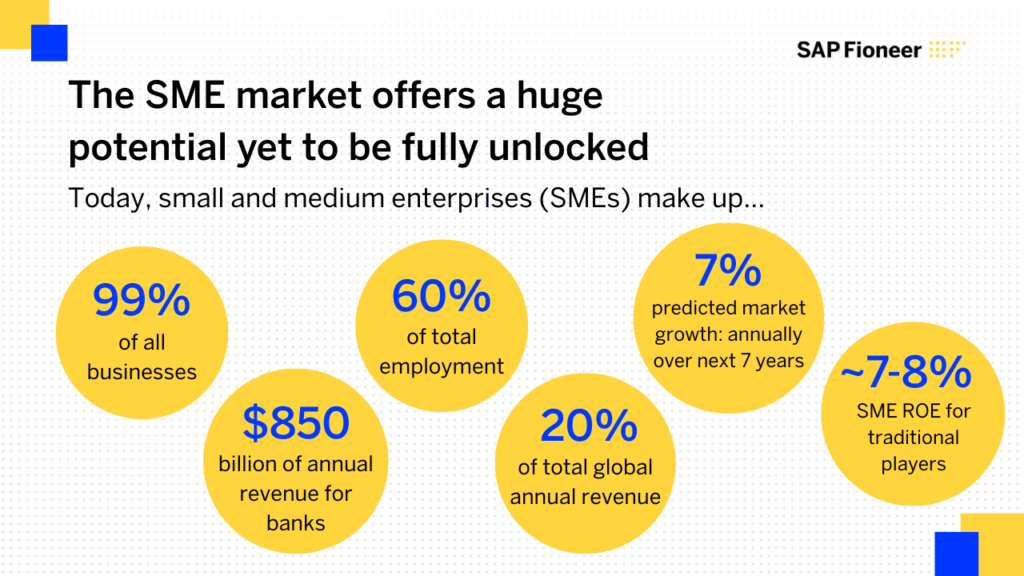

In the face of changing customer expectations, technological advancements and increased competition, banks need to transform their business models to grow sustainably and better meet the needs of small and medium-sized enterprises (SMEs).

This blog post will guide you through the journey of business transformation for sustainable growth in SME banking, from key drivers of change and innovative strategies to implementation patterns and future opportunities.

In a nutshell:

- New fintechs are already conquering the SME space with more customer-centric services

- Banks need to understand the context in which SMEs use their services and build smoother end-to-end experiences within the wider ecosystem

- There’s a massive opportunity in embracing AI for data analytics, personalization and automation in serving SMEs

The key drivers of business model transformation

So what is driving this need for change?

For one, customer expectations are evolving. Today’s SME customers demand digital-first banking services that are convenient, easy to use, and personalized. As a result, they now have a greater willingness to share their data – if they know that they will get a better experience in return.

At the same time, new technologies like artificial intelligence (AI), machine learning (ML), cloud, and blockchain are revolutionizing the banking industry. AI is helping personalize banking services, and facilitating sophisticated data analysis to better anticipate SME’s needs. By predicting SME credit risk, for instance, it can enable faster and more accurate decision-making. ML technology, a subset of AI, is making substantial strides in automating and streamlining back-office operations. For SMEs, this means faster loan processing, automatic reconciliation of accounts, and automated fraud detection systems. To stay relevant, banks need to embrace these technologies to stay ahead of the competition. And to provide SMEs with the latest, most innovative solutions, while improving operational efficiencies.

Increasing competition

The banking industry is also becoming increasingly competitive. Fintech companies and digital neobanks nowadays are offering innovative, customer-centric solutions. Traditional banks must rethink their business models and accelerate their digital transformation journey. This is how they can offer SMEs a compelling value proposition and differentiate themselves.

Take, for instance, Starling Bank. It’s not only about traditional banking products; they’ve extended their services to insurance, real-time notifications, and integrated bookkeeping. In particular, their business toolkit offers features that help SMEs manage their business finances more effectively, from VAT calculations to invoice generation. Similarly, Revolut has significantly expanded its offering to SMEs, delivering features like multi-currency accounts, virtual cards, and instant international payments.

Agicap, a fintech solution offering a digital CFO platform, has made cash management simpler and more intuitive for SMEs. Its features include real-time cash flow monitoring, scenario planning, and synchronization with the banking and accounting system. A traditional bank can benefit significantly from integrating such services, potentially even embedding their credit products within such platforms.

As a bank, actively managing these customer interactions and broadening the scope of services becomes vital. Simply put, banks need to offer more than just banking – they need to position themselves as partners in the growth journey of SMEs. This calls for an acceleration in their digital transformation, not only to match the pace of these fintech players but to offer a compelling and differentiated value proposition to SMEs.

“Fintechs have demonstrated customer-centricity to SMEs by looking at not just their banking needs, but in what context they require these services and make entire processes smoother for the end-user. Banks can apply similar customer-centric service design thinking when serving SMEs.”

– Thomas Becher, Head of SME Banking

Business model innovations for SME banking

These same drivers of change have opened up an array of opportunities to serve SMEs better, not only boosting customer engagement and loyalty, but also empowering SMEs to grow more effectively.

Investing in digital and mobile banking solutions allows SME customers to manage their finances in more streamlined, user-friendly ways. This also allows for more innovative pricing, like subscriptions-based and freemium models. This can help to attract new customers and generate recurring revenue streams. ING Turkey, for example, has focused on building out a digital, mobile banking platform for its SME customers so they can bank wherever they need to. ING’s Ventures – the venture arm of the bank – has also invested in several fintech startups, enabling the bank’s customers to access innovative, best-in-class solutions.

A digital-first platform

By combining a digital-first platform with data, banks can provide more personalized banking services and product offerings to their SME customers. Advances in data analytics technology enable banks with a modern technology stack to learn from and leverage data to better understand their customers’ needs – each customer interaction and touchpoint becomes a moment to learn from. This information can then be used to assess credit risk more accurately, offer tailored products and services, and improve the overall customer experience.

It also opens up more data-driven use cases. One example for this is data-based lending. Using data like past history of repayments, transactional data, cash flow and forecasts, banks can get a more granular view of SME customers and better understand their risk profile. This not only opens up a wider universe of customers – no longer excluding businesses who don’t have assets to use for collateral – it also allows for faster and more accurate loan decisions.

For banks that adopt an open, API-first approach to their overall architecture, it is also much easier to integrate with third-party providers. These can be fintechs, marketplaces or other financial institutions. They can also integrate trusted third-party data sources, such as central registries that hold data about registered businesses. For example, our SME Banking Edition can tap into UK’s Companies House to access data from there directly, improving UX and data quality. The future of financial services is multiplayer.

“The ability to tap into and process vast amounts of various data is one of the key components in successfully serving SMEs. It provides the foundation for providing deeply personalised services for this infinitely diverse customer group, ultimately increasing customer satisfaction and loyalty.”

– Thomas Becher, Head of SME Banking

By tapping into the wider ecosystem and leveraging data, banks can deliver more value to their customers and enhance their market position. But they can also look beyond traditional banking services. They can offer services like cash-flow analysis, accounting, factoring, and insurance all from one place. For example, Standard Chartered recently partnered with US-based fintech upSWOT to give its SME customers in Singapore intelligent forecasting capabilities on a single digital platform. SMEs connect the business apps they use with upSWOT and get real-time insights and dashboard analysis from the aggregated data.

Implementation strategies for business model transformation

However, it’s one thing knowing you need to change, it’s another thing to actually do it. Successful transformation requires clear planning and execution.

First: know your customers and their challenges. Speak to them and listen to what they need, and then form your strategy and roadmap around those pain points. This will help you identify the key opportunities for you to offer more value to your customers. And you can put technology and data to work to address them. Once you’ve identified the opportunity, outline the key stages of transformation.

Next, decide how you want to launch your SME solution. You can either integrate it into your existing technology stack or stand it up end-to-end (i.e., front end, orchestration, core banking) as a side-boat. This is where specialized vendors can help. For example, you can start by implementing a seamless onboarding process. This could be achieved by integrating trusted third-party data sources and expert services. An example of this is a digital identity verification service, to create a more automated account creation process. From there, you can build out tailored SME products that you know your customers need, like data-based lending products and invoice factoring.

Banks who listen to their customers and innovate their business model to meet these needs realize significant benefits, like higher average revenue per SME customer with tailored products and faster time to loan approval with digital, data-driven lending.

Future trends and opportunities in SME banking

Emerging technologies, particularly AI, will have a big impact on the future of SME banking. It will offer new challenges – and new opportunities for growth. The deep learning technology that underpins this latest wave of AI is only a few years old, but the generative AI and agentic AI applications it has produced are already incredibly powerful, revolutionizing the potential of automation and data analytics.

In addition, products like OpenAI’s Chat-GPT and Google’s Bard are showing the potential of chat-first UI. This could well be applied to SME banking. Imagine a chatbot, drawing from past and real-time transaction data, that operates as a customer’s banking and financial assistant. It could help them access the right data when they need it and find the right products and services through a natural language interface and ultimately help them grow. We might not be there yet, but it’s coming, and some SME banks are already looking into AI-powered use cases.

There is also a growing awareness amongst investors and SMEs of sustainability and environmental, social, and governance (ESG) considerations – and it is becoming increasingly important in business models. For those banks that get it right, it’s an opportunity for them to differentiate themselves and enhance their value proposition. Citi, for example, recently launched a green loan product that helps both the bank and its SME customers reduce their environmental impact and meet their ESG goals, as well as partnering with sustainable businesses to offer SMEs investment opportunities.

SMEs expect more – digital-first experiences, banking everywhere, instant services – and this is only set to increase. But those banks that recognize the pain points of their SME customers and address them, stand to gain. Our expertise at SAP Fioneer lies in not just understanding these needs. We are equipping banks with the right technology to meet and exceed them.

Related posts

North American SMEs still don’t have the digital banking they need

Why embedded finance is key to capturing the SME banking opportunity

How to build a profitable SME banking proposition

Most read posts

Virtual account management: the quick win for a stronger cash management proposition

Navigating barriers and paving the way for GenAI in insurance

The modernization dividend: Leveraging core insurance system upgrades for growth

More posts

Get up to speed with the latest insights and find the information you need to help you succeed.