- Home

- Insurance

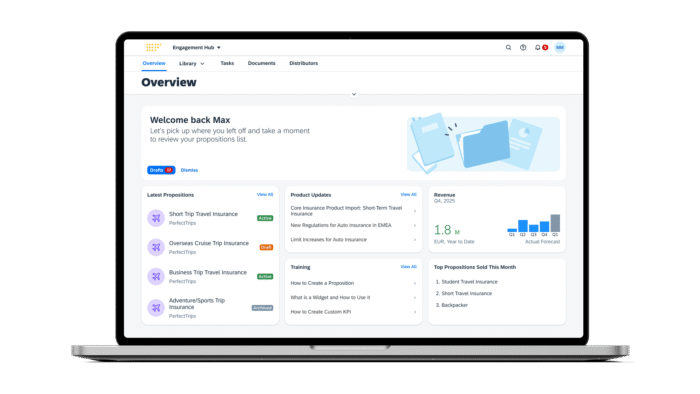

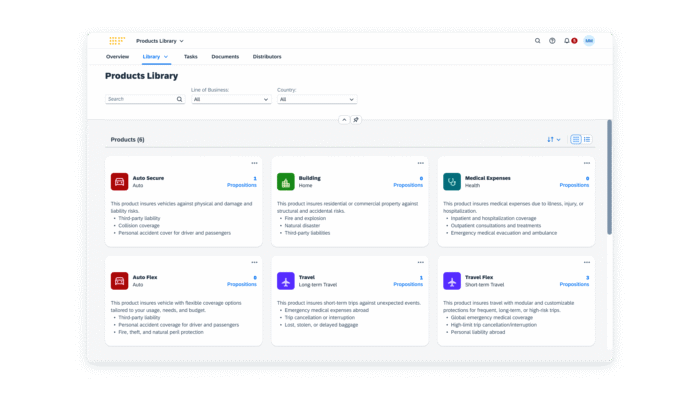

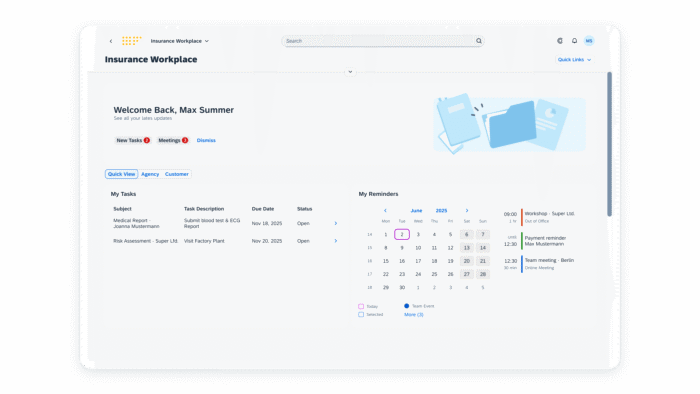

Insurance solutions to accelerate your business end-to-end

Rapidly increasing customer expectations, new distribution models and an evolving competition, mean you need a solution that is fast, future-fit, connected and proven. Our comprehensive platform gives you the agility, extensibility and reliability you need to get and stay ahead.