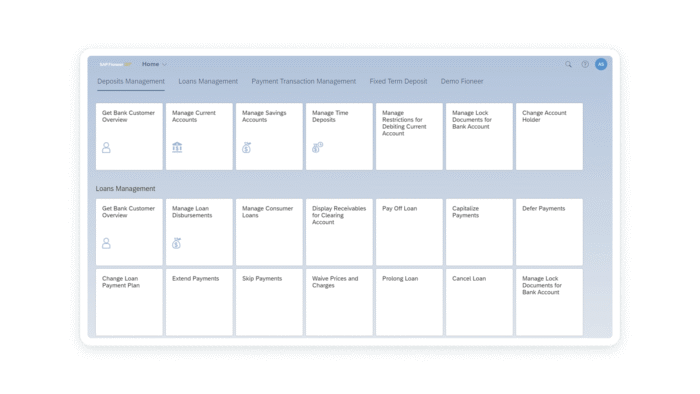

Core banking made for scale

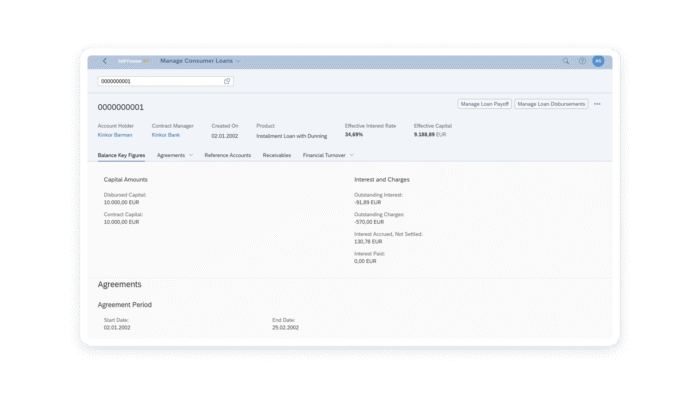

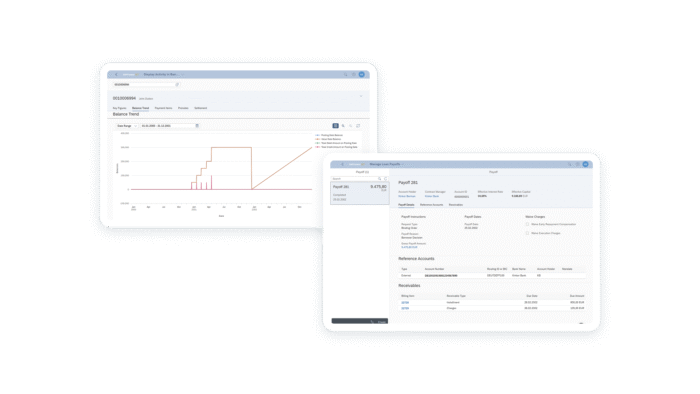

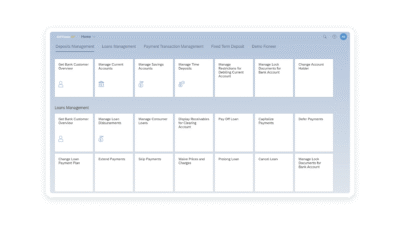

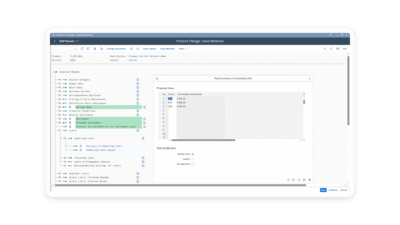

Banking is being reshaped by economic shifts, regulatory demands, and rapid technological change. To stay ahead, banks must take on the daunting task of transforming without forgoing stability. SAP Fioneer’s core banking platform, Transactional Banking (TRBK), is built to meet this challenge—enabling a future-facing, data-driven, AI-native transformation without compromising operational or regulatory resilience.