Applying SAP Fioneer’s AI innovation process to successful AI-powered products

7-minute read

Published on: 10 September 2024

Innovation with and for AI, Part 3: SAP Fioneer’s AI innovation process

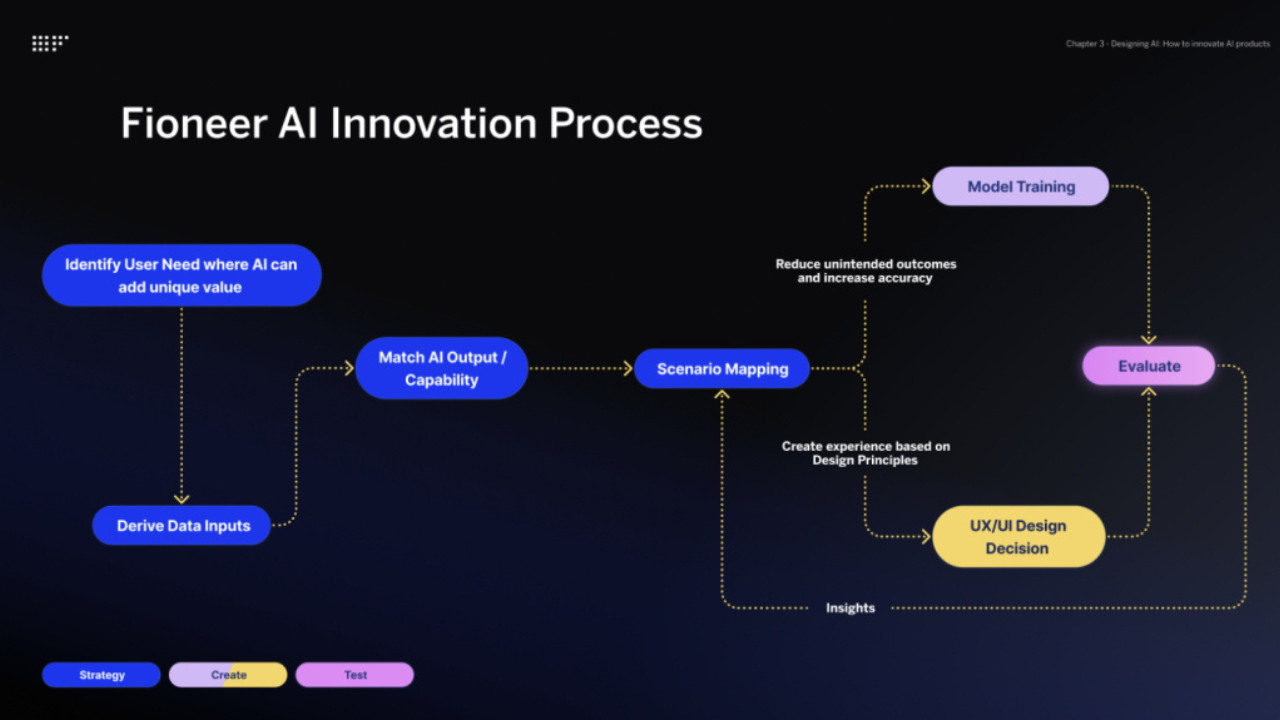

In Minsung’s last article, you learned how you might incorporate artificial intelligence (AI) tools and capabilities into your product development process. Now, let’s talk about innovating for AI and how we support that innovation. In this overview, SAP Fioneer’s Head of Product Design, Marcus Walbröl, will walk you through each of the three major stages of our AI innovation process: Strategize, Create, and Refine. By the end, you’ll have a good understanding of the SAP Fioneer AI innovation process and how you might be able to use or adapt it for your business projects.

Let’s get started.

SAP Fioneer’s initial journey into AI development

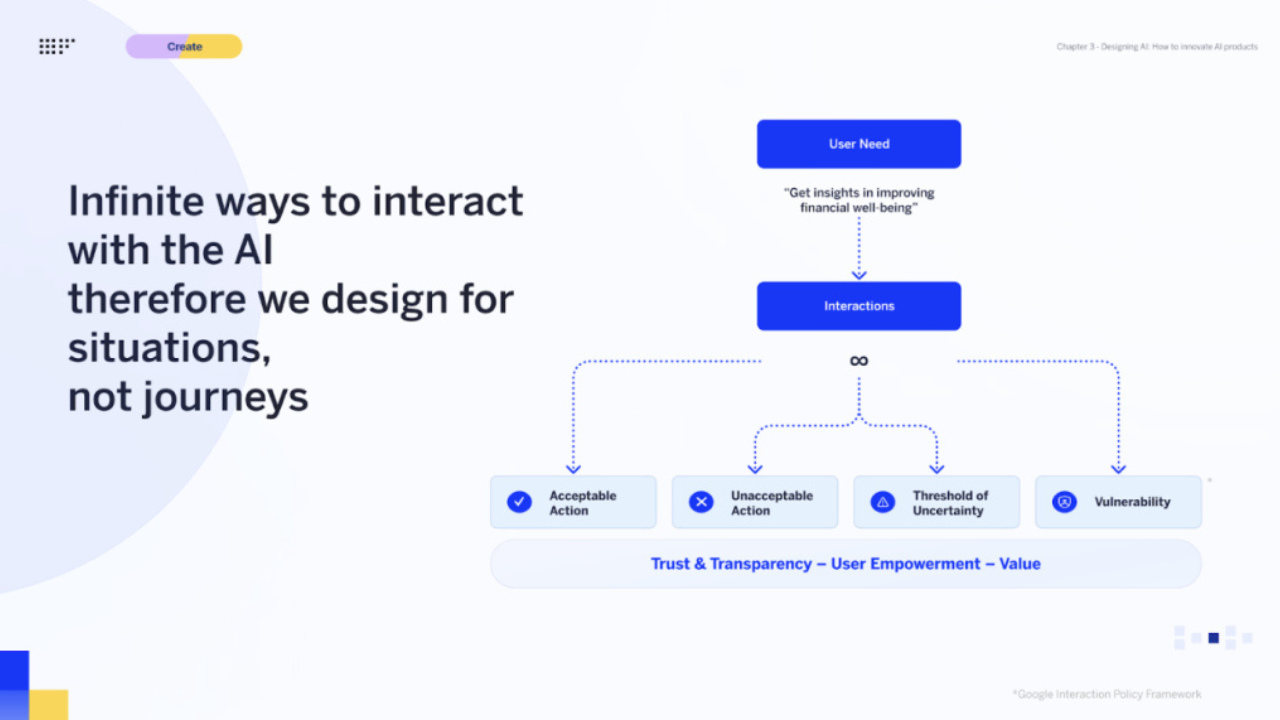

In design, just like in any other industry, AI empowers users to become explorers, Marcus explains. With AI-powered chatbots, users can now go beyond predefined “user journeys” and use their curiosity to engage with an interface. That means that interfaces become co-pilots. Instead of building new features, he adds, designers will need to teach AI tools new skills.

It’s quite the mindset shift. “In our initial journey into AI development,” Marcus says, “we realized that we needed to align customer needs with the appropriate AI outputs, understand how to evaluate AI’s capabilities, educate ourselves with new design principles, and gain a technical understanding of GenAI and the machine learning lifecycle. Only then could we really innovate with AI to the best of our capabilities.”

Although his team still starts each project by using traditional design thinking principles, like discovering user needs, they now ask a new question: can AI fulfill customer needs in a unique way? If the answer is yes, they start their SAP Fioneer AI innovation Process.

The First Phase: Strategize

Right away, Marcus explains, his team identifies a user need where they believe artificial intelligence can make a difference and deliver unique value. This is important, he clarifies: you don’t just want to use AI because you can; you want to use it because it’s the best tool for the project. Once you define that need, be it improving financial well-being or managing one’s credit score, the team can seek out the right type of model output.

Let’s say a design team wants users to be able to interact with customized notifications in their banking app to help them monitor their financial health. They’ll need transaction data, behavioral data, and maybe even data on trends in the broader market.

“Knowing the types of data,” Marcus adds, “helps us select the right AI model for the task. A design team might use the capabilities of a machine learning algorithm to get one type of output and a large language model (LLM) to get another.”

Next, once the team has its model outputs and capabilities aligned, its designers can start to map user scenarios to help them develop a trustworthy, empowering, and valuable solution. Why do we use the term “scenario” instead of “journey?” Well, there are an infinite number of ways to interact with an AI, and because AI reacts in unique ways based on the data it’s interacting with, it’s difficult to predict a typical customer journey.

Instead, design teams can predict a few most likely scenarios by simply asking “What if?” Using the Google Interaction Policy Framework, what happens, in a banking app, if:

- The prompt is precise and likely to result in beneficial recommendations? The team’s AI model should execute these as acceptable actions.

- A user requests information unrelated to financial matters; for example, asking for a recipe for lasagna? It’s inappropriate for a banking app to respond, so you’ll want to define responses like this as unacceptable.

- The prompt lacks clarity and precision? The model should prompt the user for additional information before providing any financial advice.

- The data processed by the model is inaccurate, biased or based on problematic assumptions? You might review the data and start to brainstorm how to minimize bias and iterate moving forward.

The Second Phase: Create

Once they’ve drafted these scenarios, the design team, together with the developers, uses them to derive UX and UI design decisions, as well as model training decisions. To visualize this second part of the process, it might be easiest to use a concrete example. Take, for instance, a banking tool that helps customers forecast their monthly account balance.

Technically, a design team can combine customer transaction data with other data points to create and display account predictions. But if the team wants to create a trustful, transparent and clear solution, they’ll usually build on what they learned in their scenario mapping exercise. Rather than simply presenting the customer’s account balance, they might show them which data points they used to arrive at each prediction. Or, if they want to provide users autonomy and give them control over the feature, they might add the option to adjust the tool’s data inputs.

“We may not always be certain that our financial predictions are accurate,” Marcus says, “but if we show users the model’s inputs, they can understand where the model’s prediction is coming from and make an informed choice about whether to act on its recommendations.”

In this phase, you also want to use scenario maps to prepare for the unexpected. Although your team’s engineers may shoot for perfect accuracy, teams using the AI Innovation Process will typically train their model and design the UX to also handle moments where not everything goes as planned, or where a valid result cannot yet be generated; for example, if your model has too little data to make a prediction or starts to generate predictions incorrectly.

In this way, you can minimize unacceptable events while setting the team on a path to align with our broader Design Principles: stability, robustness, trust, transparency, and user empowerment.

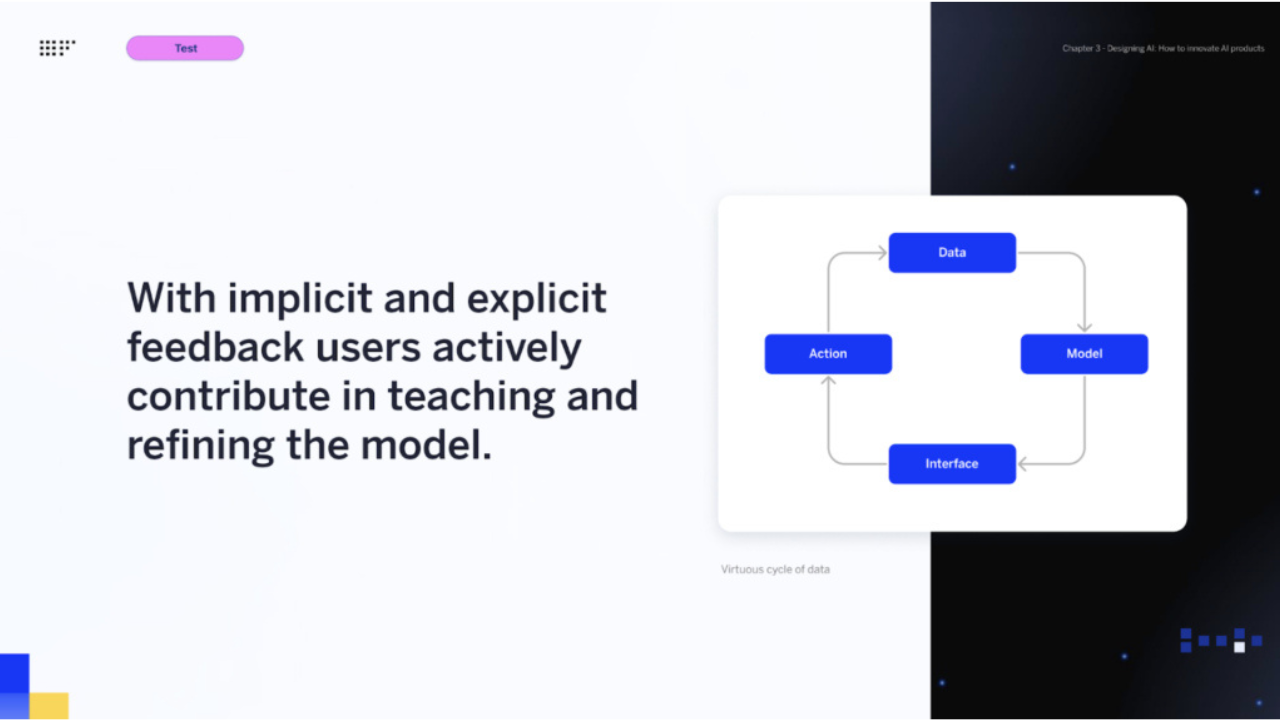

The Third Phase: Refine

Finally, in the “Refine” phase, your customers actively contribute to teaching and refining the model with a loop of implicit and explicit feedback. This input loop creates a cycle in which the model continuously receives data and adapts its behavior based on user input. Best of all, this style of feedback allows customers to co-create AI tools with your design team instead of having to adapt to predetermined UX and UI features after the fact.

Let’s share a few final examples of what this might look like in practice.

First, imagine a user who gets personalized recommendations for budgeting, investing, and spending. To create a feedback loop, we might integrate a “Thumbs up/Thumbs down” feature into our recommendation tile, empowering them to challenge misleading or unhelpful recommendations and improve the model over time.

Or if the team wants to create a customizable feature for a financial services app, they might let users tailor the new tool to their preferences. Maybe the customer wants a higher level of security or for the tool to access only some, not all, of their data. Maybe they want to confirm whether or not a model should actually execute an action. In both cases, the team lets the customer guide the model and actively shape their financial experience.

Let’s review. In this article, you learned that the SAP Fioneer AI innovation process is made up of three stages: Strategize, Create, and Refine. Each stage feeds into the next, and at each step of the process, your customers and their needs are placed front and center. Now, it’s time to use what you’ve learned to design and launch your own AI innovation projects.

Learn more about SAP Fioneer’s AI innovation process

If you have more questions about how to use or apply the SAP Fioneer AI innovation Process to the financial services sector, watch the full “Innovation with and for AI” webinar or connect with us directly. We’d love to talk about the Fioneer AI Innovation process in greater depth and chat about how it might apply to your unique business projects.

Related posts

Gen AI: The next step in digital transformation

Using AI tools to enhance the product lifecycle and achieve future readiness

The rise of the smart contextual experiences in financial services

Most read posts

Unlocking scalable AI in insurance from the core

Rethinking insurance commission complexity as a strategic advantage

What sets modern policy administration systems apart

More posts

Get up to speed with the latest insights and find the information you need to help you succeed.