ISO 20022 – The decade-old standard banks still aren’t ready for

11-minute read

Published on: 21 November 2025

First introduced in 2004, ISO 20022 was meant to usher in a new era of simpler, data-rich payments, implemented by banks and their customers. More than two decades later, banks are still playing catch-up and struggling to leverage the standard fully.

Already used in at least 70 countries, ISO 20022 has become the preferred standard for instant payment schemes and Real Time Gross Settlement (RTGS) systems worldwide. By the end of 2025, it’s estimated that 80% of RTGS transactions will use the standard.

But the pressure to adopt ISO 20022 isn’t just about keeping up with industry peers. A looming deadline makes it mandatory: All cross-border and correspondent banking payments over SWIFT will need to use ISO 20022 by Nov. 22, 2025, when legacy MT messages are retired. Yet even as banks race to meet this compliance milestone, many will still fall short of realizing the standard’s full potential. The coexistence phase may end, but for most institutions, true interoperability, data harmonization, and value extraction will remain a work in progress.

Meeting this requirement is challenging – not only because many banks still operate on decades-old infrastructure, but also because payment market infrastructures are now adopting ISO 20022 in varying ways, forcing banks to constantly adjust. Patching legacy systems for compliance is expensive, with up to 70% of IT budgets already dedicated to meeting regulatory demands. That leaves little room for investment in the kind of innovation needed to fully leverage standards like ISO 20022 – all while consumer demand for faster, easier payment experiences continues to rise, adding further pressure.

In short, banks must balance regulatory deadlines with the need to innovate. ISO 20022 opens the door to richer data, smoother cross-border transactions, and new payment innovations, but seizing that opportunity requires updating infrastructure in a way that’s cost-efficient and flexible. This article explores:

- The complex reality of ISO 20022 adoption

- How banks can break free from the cycle

- How Payment Central helps turn payments from a compliance burden to a competitive advantage

- Case study: How Payment Central solved legacy payment challenges for a UK retail bank

The complex reality of ISO 20022 adoption

Adoption of ISO 20022 has been a step in the right direction, offering a more structured, data-rich approach to payments than legacy formats. But despite its promise, the reality of implementing this new messaging format means banks are unable to realize its full potential. Here’s why.

Inconsistent implementations of ISO 20022 have led to inefficiencies and increased costs for banks

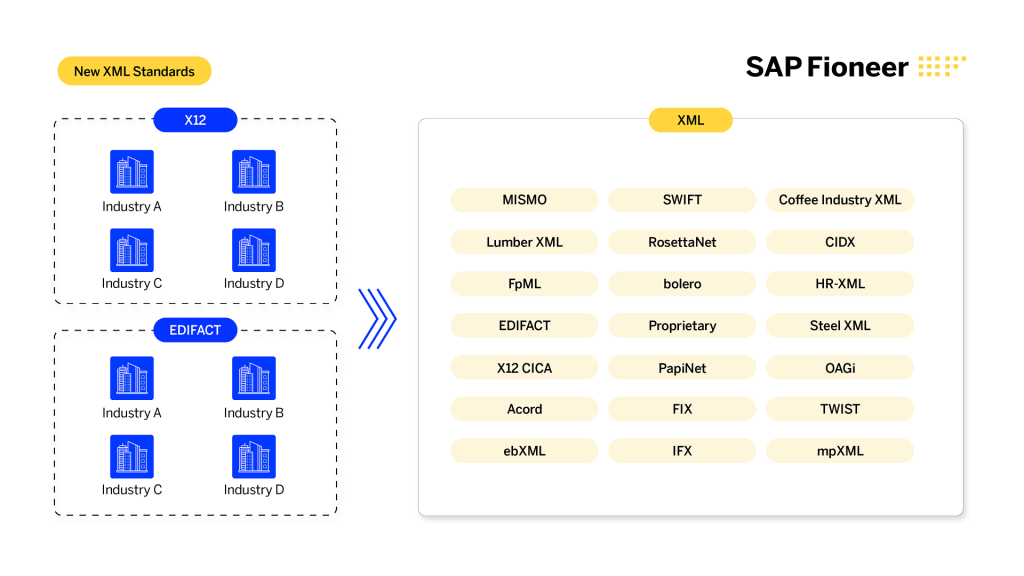

In the early 2000s, the industry saw an explosion of XML standards after frustrations with traditional electronic data interchange (EDI) formats. But this quickly led to inefficiencies, with banks having to support 20+ payment messaging XML types.

Payment experts worked to consolidate these standards and, in 2004, the International Organization for Standardization officially approved ISO 20022. The standard’s watershed moment came in 2008, when the EPC selected ISO 20022 for SEPA credit transfers. From there, adoption of the standard grew steadily.

But while most participants are now “in the same park,” they aren’t all in the same exact spot. For instance, SEPA, MX, Fedwire, CHIPS, and RPT all use different implementations of ISO 20022. Various systems are also migrating at different speeds. Low-value domestic systems, for example, have been slower to move to the new standard.

This means that their legacy systems constantly need ongoing updates to accommodate the varying implementations – updates that are time-consuming, complex, and expensive. In fact, 60% of payment IT budgets.

Evolving requirements mean banks are constantly playing catch-up

In addition to inconsistent implementation, banks also have no choice but to support what their local market infrastructure requires. As Fedwire, SWIFT, and other systems release new rules, what might have been considered compliant a few years ago often needs revisiting today. The result is an expensive and constant loop of adjustments to legacy systems.

In order to keep costs low, nearly half of institutions take a conservative approach. One survey found that 48% of U.S. financial institutions say they’ll only implement the minimum requirements for Fedwire and SWIFT, with no plans for broader change.

The result is that banks spend millions just to stay compliant, while missing the chance to take advantage of the richer data and operational efficiency that ISO 20022 was designed to deliver.

This cycle prevents banks from realizing the format’s full value potential and modernizing payments

Banks that are just playing catch-up or doing the bare minimum aren’t fully leveraging what ISO 20022 can offer.

The standard carries more data than legacy messaging formats, enabling richer, better-structured reference information. Ideally, banks could use this data to create a fully integrated payments experience, giving them an end-to-end view of operations from the initiation and delivery of the payment to exceptions, investigations, and reporting.

Survey results highlight the top benefits ISO 20022 could provide:

- 48% of respondents identified improved transaction transparency and better fraud monitoring as the main benefit

- 33% cited the ability to leverage structured data for value-added customer services

- Other benefits mentioned included enhanced customer experience and self-service opportunities, more precise tracking and tracing, higher straight-through processing rates, improved interoperability, and better liquidity insights.

ISO 20022’s adaptability means it can respond to economic changes, emerging technologies, and new innovations – but only if banks move beyond minimal compliance. When ISO 20022 is implemented in silos or only at a minimum level, banks miss both current benefits and future opportunities.

How banks can break free from the cycle

Banks need a clear plan for modernizing their payments structure. Being ISO 20022 compliant is one thing, but reaping its full benefits requires a strategic approach across three trajectories:

- IT modernization. Understand and embrace APIs, SaaS, and cloud technologies to build flexible, scalable systems.

- Market infrastructure readiness. Settlement systems and payment networks are constantly evolving. Banks must be prepared to adapt quickly as requirements change. This is not a one-and-done task.

- New service opportunities. With richer, structured data and modern infrastructure, banks can evaluate and offer value-added services that weren’t possible decades ago.

Achieving this under tight budget and time constraints will be challenging. Banks rarely have more than a one- or two-year budget cycle, so modernization requires systems that can address all three trajectories. This means adopting agile platforms that can connect to multiple systems via APIs while also letting banks course-correct and pilot new offerings without rebuilding the underlying infrastructure.

How Payment Central helps turn payments from a compliance burden to a competitive advantage

SAP Fioneer’s Payment Central is a modern payment hub built to handle every payment type – local, cross-border, and real-time – 24/7 through one scalable, compliant, and resilient solution. Whether starting with one rail or transforming an entire setup, Payment Central adapts to a bank’s architecture, strategy and pace.

Pre-integrated with major schemes like SWIFT, BACS, Visa, and Mastercard, and equipped with built-in compliance and AI, smart routing, and exception handling, Payment Central helps banks simplify compliance, adapt faster, and free up resources for innovation.

Here are a few ways Payments Central enables banks to fully implement and reap the benefits of ISO 20022.

Simplify ISO 20022 adoption with seamless multi-version support

Rather than juggling multiple fragmented systems and inconsistent messaging formats, banks can unify them all into one central hub with Payment Central. The platform provides full interoperability across different formats, rails, and systems, and is future-proofed through ongoing product enhancements.

Payment Central supports all ISO 20022 formats while remaining compatible with legacy SWIFT MT messages, ensuring smooth integration with traditional interbank networks and correspondent banking systems. It also enables card-based transaction processing across networks like Visa and Mastercard.

Instead of dealing with costly upgrades and ongoing maintenance to legacy systems, a bank can route payments through Payment Central, which has compatibility and compliance built in. This approach simplifies operations, with customers reporting back to SAP Fioneer up to a 65% reduction in operating costs.

Build on top of legacy systems with a modular, agile and open system

With Payment Central, banks can modernize at their own pace rather than be forced to overhaul legacy systems to meet new requirements. Its modular, open architecture lets banks adapt to evolving payment standards and customer expectations without disrupting existing operations.

Payment Central integrates easily with SAP or third-party core platforms via open APIs and offers multiple deployment options, from on-premises to SaaS, with a hyperscaler of choice. Plus, through SAP Business Technology Platform (BTP), banks gain access to over 160 additional connectors, enabling smooth integration across a wide range of ecosystems and partners.

This approach makes it easy to add new payment instruments, services, or innovations, such as stablecoins or CBDCs like digital euro. While a bank might not have a particular capability today, it has the flexibility to connect to a system tomorrow that does.

Free up resources for faster innovation and better operational efficiency

Manual workflows, siloed systems, and constant regulatory updates slow teams down, drive up costs, and leave little room to focus on innovation. Scaling is expensive, while launching new products or payment rails can take months, if not longer.

Payment Central addresses these challenges head-on. Natively built for SAP S/4HANA and running on the in-memory HANA database, it delivers high-speed, high-volume payment processing with real-time visibility. It can process over 20 million payments daily, within one high-capacity installation across rails and currencies with 99%+ STP. Meanwhile, intelligent workflows maximize automation, so banks can scale without adding headcount.

Compliance headaches are also resolved. With automated updates and preconfigured rules, Payment Central adapts to evolving standards without tying up teams or budgets in ongoing regulatory maintenance.

With efficiencies in place and resources freed, banks can focus on innovation. Payment Central’s no-code/low-code tools, configurable business logic, and packaged business capabilities (PBCs) make it easy to roll out new features step by step, reducing time to market by up to four times for new products, rails, or formats.

How Payment Central solved legacy payment challenges for a UK retail bank

A UK-based mutual financial institution, serving retail customers with banking, savings, mortgages, and insurance products, faced critical challenges with its legacy payment systems. Built around a 1980s mainframe and supported by in-house solutions on unsupported platforms, the infrastructure struggled with batch payments.

The threats were significant, including customer service issues, failure to pay vulnerable customers on time, long outages, loss of essential skills due to retirement, and unsustainably escalating costs.

SAP Fioneer’s Payment Central offered a modern payment hub that could handle high-volume batch processing across Bacs and Visa schemes, accounting for close to three billion transactions annually. Within six months, SAP Fioneer engineers delivered a new standard solution for Bacs.

The results:

- Increased customer satisfaction. The new system enables payments to be delivered on time while providing on-demand information that can answer customer queries quickly.

- Improved resilience and sustainability. Freed from frequent legacy system failures, staff can focus on business growth, with the system built for long-term operational and cost sustainability.

- Simplified payments operations. Replacing 8+ legacy applications with a single hub simplifies and standardizes payment operations.

This transformation positions the bank to make its payment operations more efficient and reliable without adding complexity, while building a scalable foundation for future growth.

Payment modernization needs to become top priority for ISO 20022 to succeed

Banks are trying to keep up with ISO 20022 deadlines and rising customer expectations, but simply patching fragmented legacy systems is costly, inefficient, and limits their ability to innovate. To reap the full benefits of ISO 20022 and the enriched data it enables, banks need connected, agile workflows that bring speed, flexibility, and resilience to every stage of the payment lifecycle.

With SAP Fioneer’s Payment Central, banks can replace patchwork systems with a single scalable and compliant hub. The platform automatically supports evolving standards, while its modular architecture lets banks adapt quickly without disrupting existing operations – freeing resources for growth and innovation.

Request a demo today to see how SAP Fioneer’s Payment Central can help your bank turn payments from a compliance burden into a competitive advantage.

Related posts

Wie KI die Effizienz im Zahlungsverkehr neu definiert

Cross-border payments without borders: from SWIFT to emerging rails

Real-time payments – always on, but are banks always ready?

Most read posts

Unlocking scalable AI in insurance from the core

Rethinking insurance commission complexity as a strategic advantage

What sets modern policy administration systems apart

More posts

Get up to speed with the latest insights and find the information you need to help you succeed.