The end of incrementalism: how AI is reshaping core banking priorities

7-minute read

Published on: 11 February 2026

AI isn’t replacing the core – it’s exposing what it needs to become.

For years, large banks have faced the same challenge: everyone agrees they need to modernize their core, yet operations continue to run on the same layered stack – stable and reliable enough but overly complex and fragmented, ultimately slowing progress. Meanwhile, digital channels didn’t wait and moved ahead anyway. Cloud adoption matured. New digital tools were layered over legacy systems. And deep inside the bank, systems designed for another era kept doing the heavy lifting.

AI has changed the conversation – not by replacing core systems, but by making the gap between what banks want to do and what their core can support impossible to ignore.

Real-time decision-making, embedded compliance and intelligent automation all rely on the same foundation: clean, connected, explainable data in real-time. And standardized, resilient processes to support it.

AI adoption often starts with a few use cases, but institutions quickly realize the infrastructure isn’t ready.

That’s the forcing function. AI hasn’t created a new need for modernization; it’s just removed the last reasons to delay it.

The legacy problem the FSI industry managed well – until “well” wasn’t enough

Banks didn’t end up with hybrid estates by accident. They optimized for safety, continuity, and risk control. It’s why the industry works.

But the cost of staying in this loop shows every time a product launch takes quarters instead of weeks. It shows every time a reporting change requires careful choreography across teams. And it shows every time a pilot stalls because the data takes days to reconcile.

The market is moving faster than most technology stacks can keep up.

Consider real-time payments: industry research shows the share of institutions offering real-time payments capability grew from roughly 50% in 2024 to nearly two-thirds in 2025 – an acceleration driven by customer expectations and competitive pressure. The catch? Many banks still prioritize front-end experience while the back-office lags behind, which is exactly where AI hits the limits of legacy.

The risk of downtime is also worth considering. Even outside banking, it’s estimated that large-enterprise outages cost thousands of dollars per minute – numbers that turn “technical debt” into a board-level operational exposure when critical batch jobs miss windows.

AI is not replacing the core but it does expose its limits

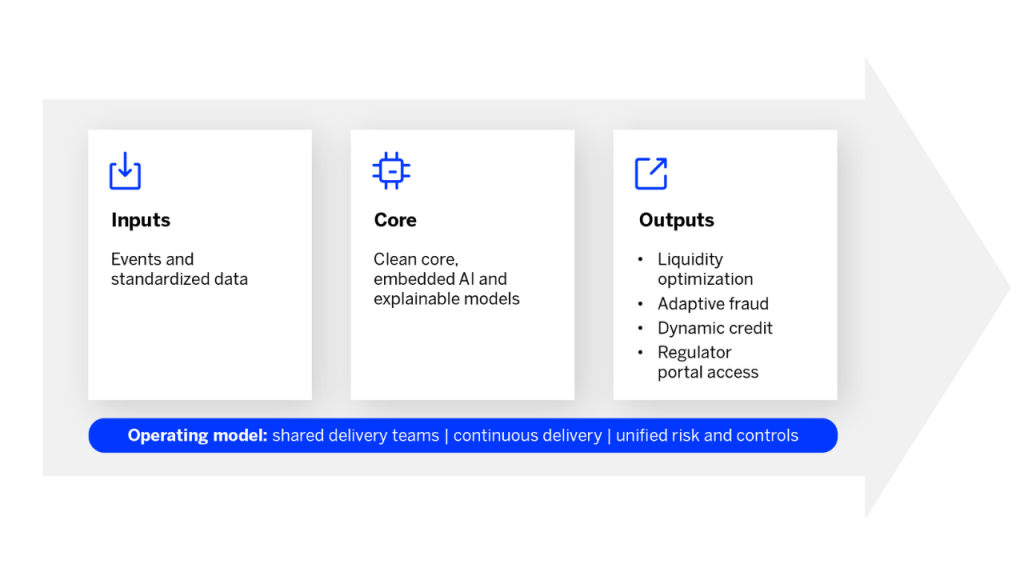

AI only works at scale when the core can supply and govern trustworthy, timely data. If a fraud model can’t see the sequence of events as they happen, it’s guessing. If a liquidity agent can’t read and write to a consistent source of truth, it becomes a dashboard, not a decision engine. Deloitte’s 2025 study on agentic AI makes the point plainly: Take treasury operations for example. Moving from scripted sweeps and manual processes to AI agents that optimize cash in real time (pricing, hedging, balancing) can dramatically improve banks’ results. But this only works if the data and the systems behind the AI agent are clean and solid.

This is why boards have shifted from asking “can we afford to modernize?” to “can we compete and stay safe if we don’t?”

The business value becomes clearer when institutions define AI outcomes that depend on architecture – risk decisions, fraud containment, capital efficiency, straight-through exception handling – not just “modern tech for its own sake.”

Deloitte’s broader “intelligent core” article echoes the same sentiment. AI is being woven into the core of enterprises, reshaping how systems make and explain decisions.

Regulation is moving from reports to real-time confidence

Regulators are already moving toward portal-based, real-time data access instead of static PDF reports – a direction that aligns with broader supervisory expectations. KPMG’s Regulatory Barometer highlights the mounting pressure for transparency, auditability, operational resilience and automation across UK/EU landscapes. This means explainability and lineage should be properties of the architecture from the very beginning, not just documentation exercises at the end.

BCG’s view from the public-sector side lines up with this too. Institutions that reach “future-built” maturity – real-time data infrastructure plus AI capability – are better positioned against new fintech and big-tech competition. This isn’t about superficial innovation. It’s about building a solid foundation that lets banks innovate safely.

Pace looks different by region, but the direction is the same

Not every market is moving at the same speed.

In regions like the Middle East, particularly Saudi Arabia, expectations for speed are high – and the mandates and capital are already there to push things forward. A proposed three-year timeline for a core banking transformation seems slow compared to how quickly large-scale infrastructure projects are delivered.

Africa shows how innovation can move quickly and last, especially when it’s not held back by decades-old legacy infrastructure. In Europe and North America, modernization is happening at scale: simplifying products, streamlining systems and building real-time data foundations, one business line at a time.

Different starting points, same destination.

What “AI-ready core” really means (hint: it’s more than the cloud)

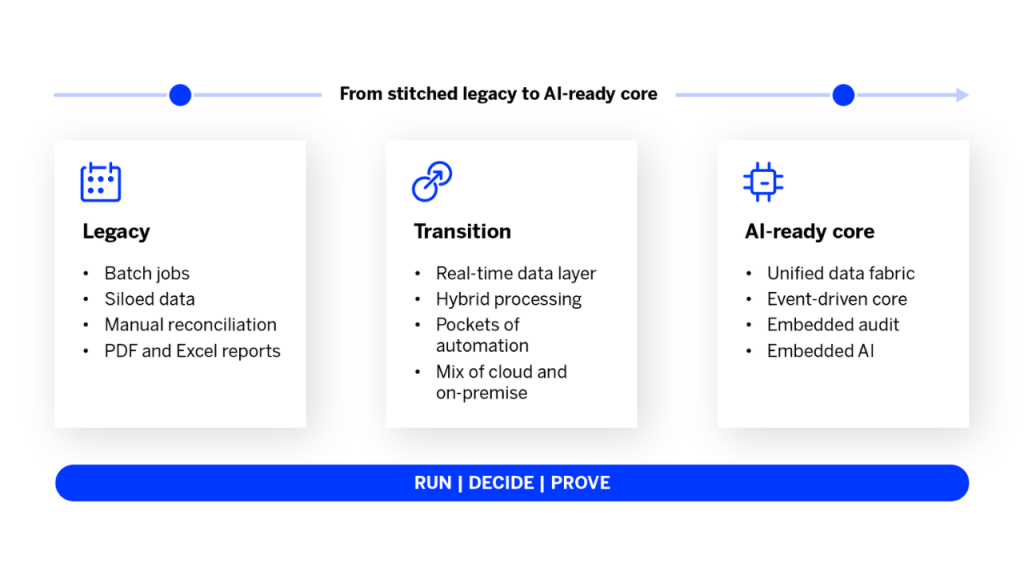

The next core isn’t a single box. It’s a connected operating capability that can run, decide and prove in real time.

It has a data fabric that unifies operational and finance data with lineage to source transactions, so models and regulators can see exactly where numbers come from. It has an event engine that processes changes as they happen, so decisions are made in flow, not after the fact. And it treats compliance as part of the runtime, not a downstream report.

The responsibilities of vendors will continue to increase as banks ask platforms to shoulder more of the resilience and regulatory burden. That shifts partner conversations from just “features” to shared operating outcome.

Don’t start with “new core” – start with the value modernization adds and the foundation that enables it

The most effective Tier 1 and Tier 2 programs we see don’t begin by declaring a full system replacement. They start by naming the capabilities only modernization can deliver like real-time liquidity, adaptive fraud, explainable credit and event-driven collections.

From there, they focus on building the data and processing foundation that allows those capabilities to scale across the business.

This approach avoids the risk of switching everything at once while still reaching the same strategic goals. It also opens the door for ecosystem partners to support change without disruption. Even in services, moves like Accenture’s acquisition of a banking “digital twin” platform show how banks can modernize with less disruption. These tools help simulate transitions, reduce risk, and speed up change – valuable approaches for banks planning transformation.

Talent may be the real bottleneck (and the advantage)

Technology constraints are only half of the story. The other half lies in the structure of talent across many banks. In most institutions, the skills pyramid has become top-heavy, with deep legacy expertise concentrated at the senior level and too few early-career engineers coming through to support modern delivery models.

Hiring alone won’t solve this problem. What’s needed is a broader approach: joint development centers with partners, early-career programs that blend banking and software engineering, and cross-functional rotations that bring everything (and everyone) together.

Banks that treat modernization as a capability ecosystem – and not just a staffing issue – move faster and build resilience.

Modernization value chain

The bottom line for core leaders

We’re past the “wait and see” phase.

AI turns core modernization from a technology preference into an operational, regulatory and competitive requirement.

The winners will treat the core as the engine of trust and intelligence – able to run the bank, explain the bank and continuously improve the bank.

If there’s one takeaway, it’s this: AI isn’t the reason to modernize. It’s the moment banks can no longer avoid it.

Related posts

Cost: The “Five C’s” that challenge mortgage servicers

Wie KI die Effizienz im Zahlungsverkehr neu definiert

The future of lending in EMEA: Looking ahead to 2026

Most read posts

Unlocking scalable AI in insurance from the core

Rethinking insurance commission complexity as a strategic advantage

What sets modern policy administration systems apart

More posts

Get up to speed with the latest insights and find the information you need to help you succeed.