Why finance modernization is the key to competing in today’s digital, data-driven FSI market

8-minute read

Published on: 28 October 2025

Banking and insurance finance has moved from a reporting function to a core driver of business performance. Yet fragmented systems and manual processes are preventing finance teams from delivering timely, cost-effective insights, compromising their ability to remain relevant and resilient in a changing market.

A McKinsey survey shows many CFOs reporting that just one-quarter or less of their finance processes are currently digitized or automated. This limits efficiency, reporting speed and regulatory compliance. It also makes it difficult for heads of finance to give reliable guidance to business leaders and leaves them unprepared for future demands.

Modern AI-driven finance platforms offer a way forward. They improve efficiency by unifying data, automating processes and strengthening compliance through consistent, auditable data. By giving finance teams the agility to adapt to new technologies and rising demands and CFOs the real-time insights needed to steer the business, banks and insurers can enable future readiness.

What is holding finance back?

Poor data quality, regulatory pressure, inefficiencies and higher costs are holding finance teams back from ensuring future relevance for their organizations. Competition raises the bar further by compressing margins and shortening decision cycles, so finance needs timely, reliable numbers for pricing, product changes and capital allocation.

1. Legacy systems reduce efficiency and flexibility

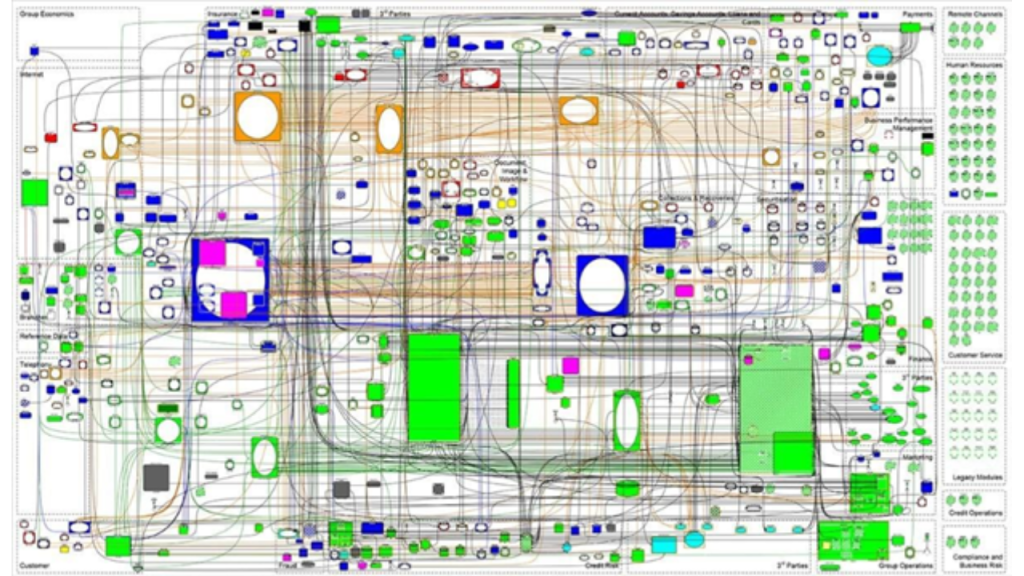

In most banks and insurance firms, finance teams still rely on decades-old legacy systems that have been patched together over time, often as a result of mergers and acquisitions. The result is a fragmented, complex infrastructure that makes it difficult to access consistent, end-to-end financial data.

A single product system, such as mortgage, is already complex because finance must often value the same loans in two ways: amortized cost for books held to collect payments and fair value for positions managed for sale or hedging. That doubles the models, data and controls needed to keep risk and accounting in sync.

So when mortgage data moves to risk and then to accounting, accuracy often slips and manual effort fills the gaps. Closing the books takes longer. Performance reporting lags. Regulatory submissions require heavy lifts from small, specialized IT teams who are nearing retirement.

In practice, teams resort to manual data entry, like copying and pasting figures between mortgage, risk and accounting, to keep work moving. These workarounds feel fast, yet they introduce delays, redundancies and risks at every step of the process.

As the complexity grows, two things rise in tandem: the cost to maintain this infrastructure and the chance of error. Transparency declines, making it harder to trust the numbers and to meet regulatory expectations. Strategic discussions then rely on partial views instead of complete, comparable data.

2. Fragmented data limits transparency and regulatory compliance

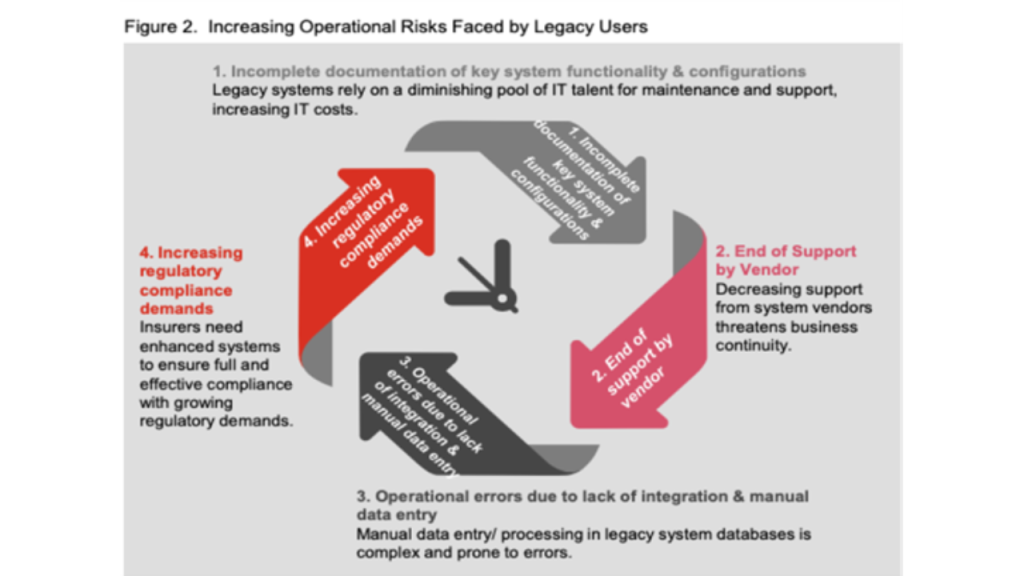

Regulators continue to demand more detailed, timely and transparent reporting from banks and insurers. This requires accurate data lineage, comprehensive audit trails and robust reconciliation.

But these are challenging to deliver in an environment of siloed systems and inconsistent data. The operational risks of failing to meet these expectations are significant as noncompliance brings not only financial penalties and increased scrutiny but reputational damage.

For example, banks with international branches must comply with regulations in each country, which often means maintaining separate data models and databases for every jurisdiction.

For many financial institutions, the need to improve regulatory reporting is the initial spark for finance modernization. But it quickly becomes clear that solving for compliance requires deeper changes to data quality, access and architecture.

3. CFOs lack tools to prepare for future business needs

t the same time, finance leaders face greater expectations than before. Once financial stewards, bank and insurance CFOs are now expected to drive performance and shape enterprise strategy. This shift requires connected, interpretable data for a comprehensive, organization-wide view with the context needed to support business decisions and not just visibility into financial close or compliance metrics.

Yet most finance teams are limited to fragmented insights because of aging homegrown systems and poorly integrated data sources that lack end-to-end traceability and meaning. The lack of unified visibility makes it difficult to assess risk exposure, steer the business in real time, or make timely strategic decisions.

Even answering basic questions, such as which lines of business are most profitable, can be time-consuming and error-prone. The CFO’s modern mandate is forcing a rethink of the entire finance operating model.

4. Rising costs and new competitors increase pressure

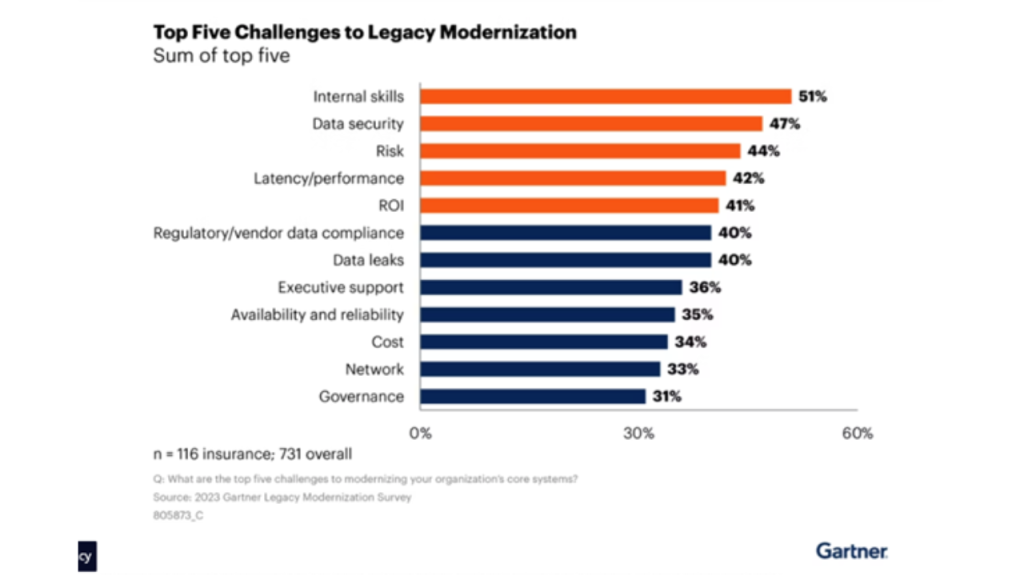

External competition is putting further pressure on banks and insurers to modernize as digital-native neobanks and insurtechs set new standards for speed, agility and customer responsiveness. Traditional organizations, saddled with technical debt and limited visibility, face higher costs and slow decision cycles.

But, while fintechs benefit from agile, lightweight architectures, they often lack the business depth built into legacy bank systems. The challenge and opportunity for banks and insurers is to modernize in a way that retains and reuses this functional and domain knowledge. Some estimates suggest that large banks could achieve $25-$50 million annually in efficiency gains by doing so.

Without modernization, however, inefficiencies and cost gaps will continue to widen and so will the competitive disadvantage. This leaves finance teams struggling to meet these digital expectations, exposing banks and insurers to missed opportunities and operational risk.

And, as the industry progresses, banks and insurers relying on outdated finance models will fall further behind.

How finance modernization creates value

“While most finance leaders are well aware of their operational challenges, meaningful change only begins when those issues become too painful to ignore.” — Wan Ting Lee, SAP Fioneer Solutions Partner, Bank Finance

Finance modernization provides the path forward for banks and insurers at an inflection point. It tackles systemic and architectural inefficiencies head-on, starting with data and streamlined reporting and lays the foundation for strategic insight and control to steer the business and remain competitive.

1. Integrated platforms improve efficiency and reduce cost

Finance modernization replaces patchwork systems and manual processes with integrated platforms. Beyond improving speed and accuracy, it creates an opportunity to redesign end-to-end processes and optimize the target operating model.

By streamlining data pipelines and standardizing workflows, insurers and banks can significantly reduce the manual effort and time required to close the books, produce reports and respond to internal or external demands. This lowers costs and optimizes the total cost of ownership (TCO).

This shift not only frees up resources, but it also reduces operational risk by eliminating reliance on fragile, bespoke processes that depend on a shrinking pool of specialized talent.

2. Standardized data strengthens compliance and reporting quality

A strong data strategy lies at the heart of finance modernization. In fact, quality data integration and system unification top the list of 2025 banking trends. With over half of financial institutions prioritizing AI investments, banks and insurers recognize that without consistent, accessible data, they cannot deploy new technologies like Agentic AI effectively.

But it’s not only about the data itself. Understanding how data is produced—its context, lineage and meaning—is essential. Leading platforms, like SAP Fioneer, now embed tooling that captures this semantic structure and preserves it from end to end. This enables more accurate interpretation, better governance and sustained data quality at scale.

3. Finance gains the visibility for future-focused decision making

Data must be timely, traceable, auditable and complete to support not only compliance, but also the advanced analytics and forecasting capabilities needed for future competitiveness.

By unifying data sources across business lines and ensuring consistent standards for quality and traceability, banks and insurers can achieve real-time visibility into financial and operational performance, profitability and risk exposure.

This enables faster, more confident decision-making across multiple domains and functions, from capital planning to cost control. It also lays the groundwork for more advanced capabilities, including AI-driven forecasting and scenario modeling, both of which depend on complete, reliable data.

With clean data and integrated systems, the finance function can finally surpass hindsight reporting to provide forward-looking insight into how the organization is performing, whether by product, customer segment, or geography.

CFOs and their teams can help leadership understand which lines of business are creating value or yielding subpar returns and why. They can model trade-offs, identify bottlenecks and support capital allocation decisions with clarity and confidence. This is the vision for a modern finance function: not as a cost center, but as a partner in driving performance for today and tomorrow.

Modern finance is now a competitive requirement

Finance modernization is a strategic choice with early benefits. Institutions that standardize data, simplify architecture and automate core processes gain three advantages. First, lower cost and fewer errors from reduced manual work. Second, higher reporting quality with clear lineage that meets regulatory scrutiny. Third, a timely, consistent view of performance that supports capital, cost and growth decisions.

The finance function shifts from retrospective reporting to fact-based guidance on where value is created and where it is not. This is how banks and insurers keep pace with digital competitors while preserving the strengths of their core businesses.

To find out how SAP Fioneer’s Finance Platform can help banks and insurers modernize contact your account representative or visit our website and book a demo.

Related posts

What to demand from a finance data solution built for banks and insurers

The true cost of poor data quality in banking and insurance

Why some digital finance modernizations fail (and how to ensure success)

Most read posts

Unlocking scalable AI in insurance from the core

Rethinking insurance commission complexity as a strategic advantage

What sets modern policy administration systems apart

More posts

Get up to speed with the latest insights and find the information you need to help you succeed.