Why some digital finance modernizations fail (and how to ensure success)

11-minute read

Published on: 19 December 2025

Banks and insurers are under growing pressure to modernize their finance operations. Regulatory scrutiny is intensifying, ESG reporting is rising in importance and real-time financial insight has shifted from a competitive edge to a baseline requirement. In addition, rising operational costs, fragmented legacy systems and an increased demand for transparency have made a modern finance platform all the more essential.

But despite this urgency, approximately 70% of digital finance modernizations fail to deliver1.

Instead of solving root problems, banks and insurers often replicate outdated processes in new environments. This leaves core inefficiencies intact, such as unreliable data and inaccurate reporting. As a result, modernization investments fall short of their promise, and risk exposure persists.

Financial institutions often overlook the need to:

- Redesign finance from end to end

- Translate embedded business knowledge into a digital form

- Ensure data carries context, lineage and meaning

Gaps in leadership alignment, multi-domain integration and process ownership further reduce the chances of sustained impact.

In this article, we’ll take a closer look at where modernization attempts fail and how financial services firms can ensure greater success in transforming finance.

Where most modernizations fail to deliver value

While all banks face similar overarching pressures, the specific challenges vary depending on regional attitudes, the nature of catalysts driving the change and their ability to articulate and execute a clear and coherent modernization vision.

Outdated processes persist behind modern tools, undermining efficiency

Many banks and insurers approach modernization as a technical migration, commonly known as a “lift-and-shift” approach that the Boston Consulting Group sees as one of the most common mistakes in modernization. Existing workflows—often manual, spreadsheet-driven and error-prone—are lifted from legacy systems and dropped onto new platforms with minimal redesign.

The result is superficial change. Regulatory reporting remains slow, reconciliations are still manual and the opportunity to improve performance management is lost.

For example, a bank currently using outdated accounting software takes exactly the same manual data entry, spreadsheet-based reconciliation and inefficient regulatory reporting processes and simply moves them to a cloud-based version of similar software. By doing so, it retains all existing inefficiencies, such as poor-quality data.

In some cases, organizations upgrade their general ledger in response to vendor sunset timelines or cloud migration strategies, assuming this will bring broader benefits like improved reporting speed, reduced manual effort or better integration with downstream systems. In reality, they often lose access to the granular data needed for compliance and internal reporting and planning. Finance teams are forced back into legacy source systems, recreating manual work that should have been eliminated with modernization.

Continuing to rely on outdated systems in modernization limits ROI and strategic value. Banks and insurers spend significant money and resources just migrating to a new platform without actually solving deeper issues around data quality, automation, efficiency and the strategic role of finance in driving performance.

Fragmented data strategies derail progress

Banks and insurers operate with deeply fragmented architectures. After decades of mergers and incremental tech adoption, financial data is spread across dozens of systems, each with its own definitions, formats and timelines.

But, without a unified data model or clear lineage,

- Automation becomes difficult

- Reporting suffers

- Regulatory submissions are delayed

- Financial closes are prolonged

- Operational risk rises

- AI and other tech initiatives are compromised

Banks and insurers often underestimate these challenges until late in the project lifecycle, when functional gaps appear during testing. At that point, delays and budget overruns are common, and critical defects become difficult to resolve without major rework.

Misaligned priorities and underestimated complexity that compromise reporting, compliance and decision making

Modernization projects frequently begin with the wrong assumptions. Many insurers and banks believe that modernizing a sluggish general ledger or building a subledger in-house will address systemic issues. But both approaches often fail.

Upgrading core systems without a coherent data strategy can introduce performance issues or omit key financial details. Custom-built/homegrown subledgers typically underestimate the complexity of banking and insurance processes and lack the domain-specific functionality required to deliver reliable reporting and compliance.

For example, a bank may complete the migration of its general ledger to a cloud-based platform on time and within budget. However, because the project focused only on infrastructure, finance teams still rely on spreadsheets for reconciliations. Data silos also persist across business units, and regulatory reports require the same manual effort as before. The result is a modernized system that looks new but fails to improve decision-making, efficiency or compliance readiness, ultimately delivering little strategic value.

Inadequate change management and absent leadership hinder implementation

Modernization requires internal leadership. In many cases, there is no single accountable owner driving alignment, decision making or outcomes. Without this crucial figure, projects stall due to competing priorities or unclear requirements.

Teams are also frequently overstretched. They must maintain daily operations while executing large-scale changes, often without added resources (e.g., FTEs). Resistance to new tools or processes—particularly in regions where change is culturally sensitive—can compound the problem.

Without effective change management and stakeholder support, even well-designed systems fail to gain traction.

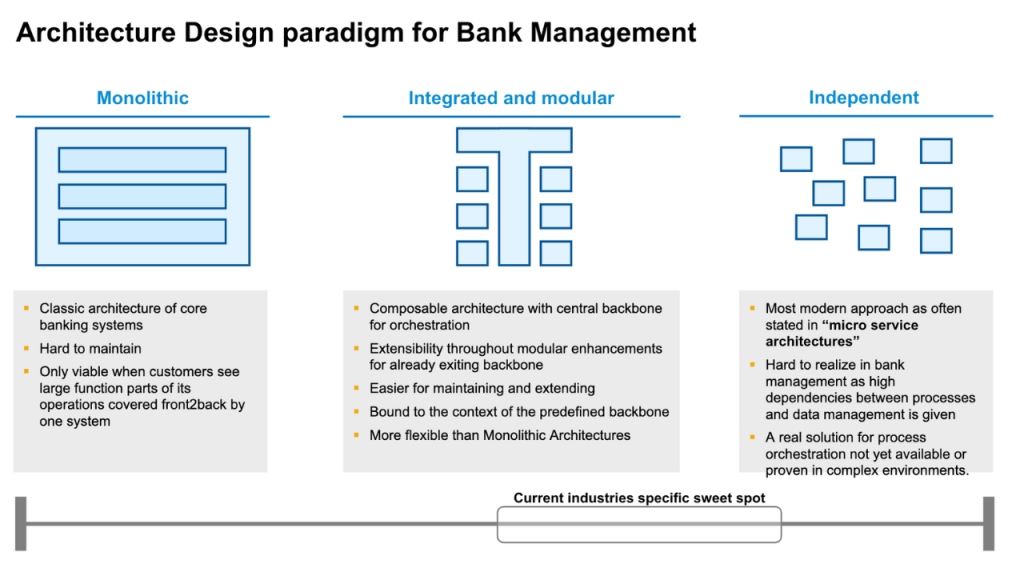

Architectural barriers prevent true modernization

Banks and insurers don’t just struggle with fragmented data. The underlying architectural patterns themselves often create barriers to modernization. In our work with large institutions, we see four recurring models. Each solves immediate needs but also carries trade-offs that can undermine modernization if not addressed.

- Monolithic core systems

Many banks and insurers still rely on tightly coupled, decades-old core platforms. These systems are proven and well-understood, but are rigid, costly to maintain and hard to evolve. Modernization projects that leave them untouched risk hitting a wall when new requirements for speed, flexibility, or compliance emerge. - “Fat tail” data warehouses

Data warehouses were meant to consolidate information into one place, but in practice they collect data at the end of the process chain (the “fat tail”). That means quality and consistency issues surface late, when they are expensive and slow to fix. The result is often a “single copy of the truth” rather than a true single source. Modernization projects that build on this model inherit the same late-stage reconciliation bottlenecks that require manual intervention. - Domain silos

In many institutions, domains like lending, payments or claims run on their own systems tailored to local needs. While this can make each domain efficient, it prevents enterprise-wide consistency. It also makes regulatory compliance and strategic decision-making harder because no one has a complete view of the data. Modernization programs that leave silos in place struggle to deliver unified reporting or a reliable financial close. - Data mesh and microservices

Some institutions are experimenting with decentralized, microservice-driven models. While attractive in theory, this approach shifts complexity rather than removing it. Synchronization, governance and integration become the new bottlenecks. At scale, especially in large, regulated banks, these models are still unproven for their efficacy.

These architectural patterns explain why so many finance modernizations fail. If a program doesn’t challenge the architectural model beneath the processes, inefficiencies remain locked in.

Generic finance platforms fall short after pilot stages

While industry-agnostic solutions may suffice for simpler or less regulated industries, in banking and insurance their use often results in high risk, operational failure or outright rejection after pilot evaluations.

For example, industry-agnostic finance tools are rarely equipped for banking and insurance. Most lack built-in support for:

- Multi-GAAP accounting

- FX revaluation

- Financial instruments accounting and valuation

- Insurance contracts accounting

- Regulatory audit trails

When used in proof-of-concept pilots, they typically deliver only a fraction of the required functionality. Banks and insurers then face a choice between extensive, risky customizations or abandoning the project entirely.

Generic tools are also unable to unify data and reduce reconciliation efforts. Banks and insurers rely on transactional-level traceability across hundreds of internal systems. Generic platforms can’t ingest, harmonize or reconcile this volume of data because they lack:

- Standard models

- Prebuilt connectors

- The ability to easily customize and extend

- The traceability controls needed for accurate reporting

As a result, finance teams remain stuck in high-effort reconciliation cycles, undermining confidence in the numbers and exposing the bank to compliance risk.

Finally, non-specialist vendors often lack implementation teams with banking or insurance experience or specialized co-innovation teams. Financial institutions may go live with a platform that meets their technical requirements but fail to align with how finance actually operates in a bank or insurance environment. Without domain knowledge, these vendors often deliver new tools without addressing structural inefficiencies, offering modernization in name only.

How to ensure success: a design-led finance transformation that is platform-enabled

Modernization succeeds when the operating model and process design come first, and technology reinforces those choices. The platform is an enabler, not simply a strategy. Banks and insurers must use it to implement a redesigned finance backbone, standardize data and controls and scale automation across domains. Once institutions have defined a clear way of working, modernizing with a purpose-built, unified platform speeds up delivery, reduces customization risk and preserves auditability, supporting the process rather than dictating it.

From lift-and-shift to design-led modernization

Instead of replicating legacy processes on new technology, modernization is a design exercise first. Banks and insurers must start by fixing the process, then use technology to make the design work at scale. This approach includes automating reconciliations, standardizing data, integrating subledgers with the general ledger, enabling analytics on trusted data and aligning finance roles to the target process.

| Dimension | Lift-and-Shift | True modernization |

| Approach | Migrating processes “as-is” | Re-engineering and optimizing processes |

| Impact on Processes | Minimal changes, largely status quo | Significant process improvements and automation |

| Strategic Benefit | Low, tactical resolution | High, strategic alignment and value creation |

| Risk Management | Operational risks persist, and risk and finance are siloed | Unified finance and risk; reduces future operational and compliance risks |

| ROI | Limited, mostly infrastructure upgrade | High, efficiency gains, improved capabilities |

With target processes and controls defined, the role of technology is to execute the design reliably and at scale. A purpose-built, unified platform enables this by reinforcing standardized processes, maintaining control over data and lineage and supporting automation across domains.

Data architecture that simplifies complexity

Modernization should start with finance’s operating model and data needs.

Unified finance platforms built for banking and insurance integrate data from multiple systems into a single, reconciled model that standardizes data. This removes manual reconciliation bottlenecks and enables accurate, timely financial close. With a unified solution, full data lineage is preserved, ensuring compliance and auditability, and finance teams gain a reliable foundation for both reporting and strategic decision-making.

Cross-functional value and faster time to benefit

Purpose-built platforms unify finance, risk, regulatory, operational and performance data in one architecture and provide the support of experienced delivery teams. This allows financial institutions to eliminate duplicate systems and manage modernization through phased rollouts.

It also facilitates change management as experienced delivery teams, domain templates, standardized models and proven methodologies reduce implementation risk and accelerate results. This provides the support banks and insurers need to keep their daily operations running smoothly.

CFOs and their teams gain visibility into operations, performance and compliance from a single source of truth, without the delays, risks or compromises of generic alternatives.

An architectural model that balances stability and innovation

Banks and insurers don’t have to rely on rigid monolithic platforms.

The practical path today is a hybrid approach: a composable backbone extended with modular components and selected microservices. When applied in targeted areas, such as fraud detection, payment orchestration or customer personalization, microservices deliver innovation without destabilizing the core. Combined with purpose-built, unified finance platforms, this architecture gives banks and insurers both stability and adaptability.

Purpose-built platforms support long-term value creation

Banks and insurers require finance platforms that are purpose-built for their environment. For example, a finance platform built for financial institutions should include:

- Out-of-the-box subledgers

- Regulatory templates

- Logic that reflects the institution’s accounting, compliance and product structure

- Risk, liquidity and capital data attributes

Specialized platforms are built to support multi-GAAP, multi-entity and multi-currency reporting. They are designed to unify and standardize data and ingest, harmonize and reconcile large volumes of data, while reducing manual reconciliation efforts. A purpose-built finance platform enhances traceability, improves time to value and lowers the long-term cost of ownership.

Modernization changes the way finance works

Most modernization programs focus on technology replacement without the real change of reworking the underlying processes and operating model. Instead, modernization should lead to better data, processes and controls.

Successful teams start by redesigning finance end to end and use a purpose-built, unified platform to standardize data and lineage and implement at scale. The result is faster closes, fewer breaks, trusted regulatory reporting and a single, reliable view for decision making.

Discover how SAP Fioneer’s finance platform can ensure your modernization success. Get in touch today.

Related posts

5 data challenges in finance modernization that only industry-specific platforms can solve

Most read posts

Unlocking scalable AI in insurance from the core

Rethinking insurance commission complexity as a strategic advantage

What sets modern policy administration systems apart

More posts

Get up to speed with the latest insights and find the information you need to help you succeed.