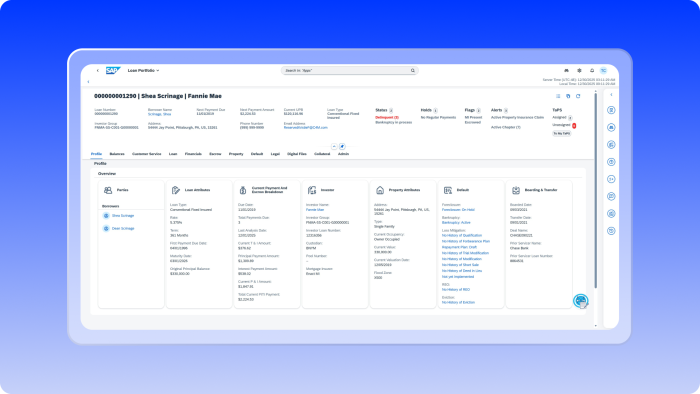

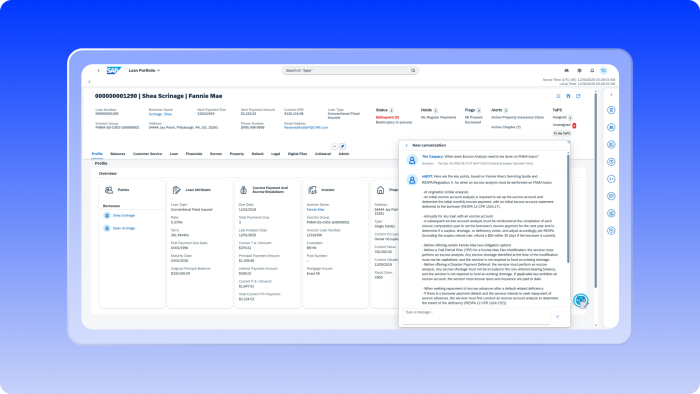

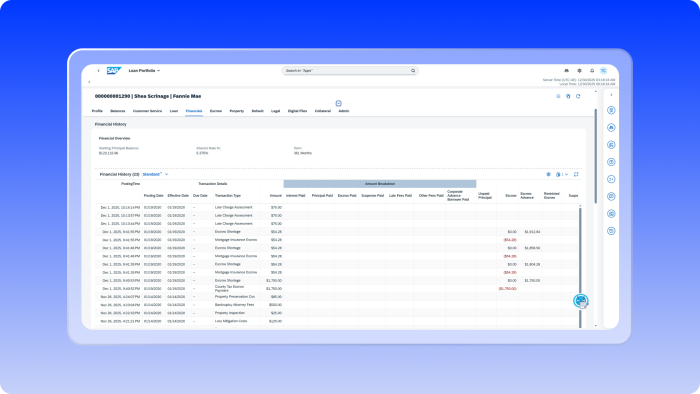

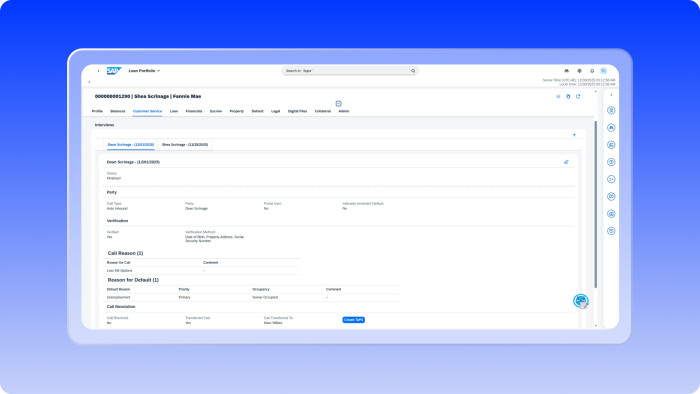

Modern mortgage servicing on an enterprise platform

Run the full servicing lifecycle in one integrated system, powered by SAP technology.

Cloud for Mortgage is a modern SaaS servicing platform designed to run the full mortgage servicing lifecycle in one integrated system—from loan boarding through REO. Powered by SAP technology, it embeds real-time processing directly into the core, eliminating the need for additional modules and manual handoffs. With a single user interface, one real-time data foundation, and one audit trail, Cloud for Mortgage enables efficient, compliant servicing at enterprise scale.