- Home

- Finance and ESG

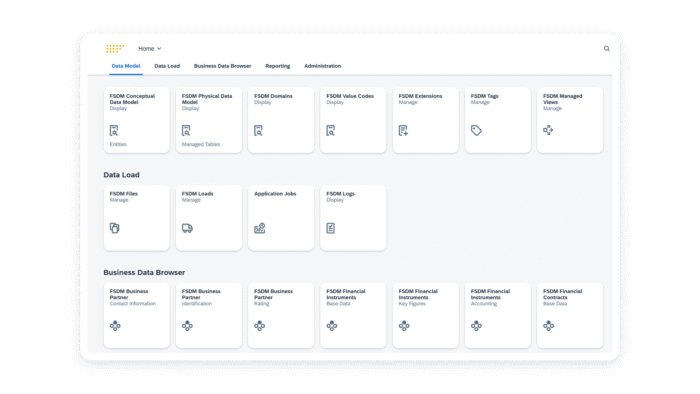

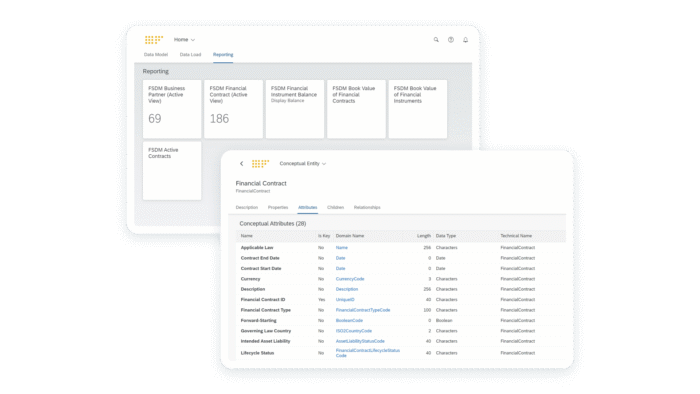

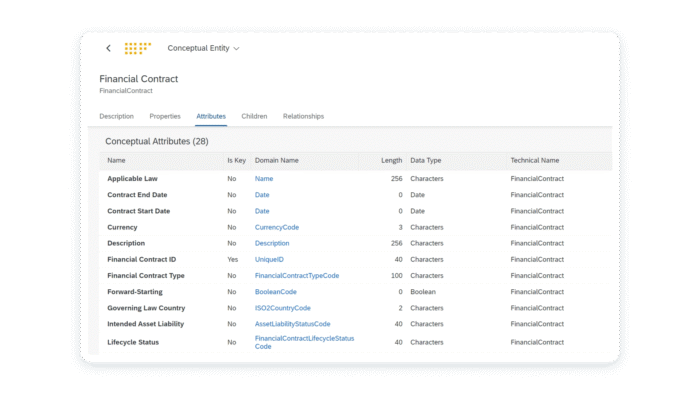

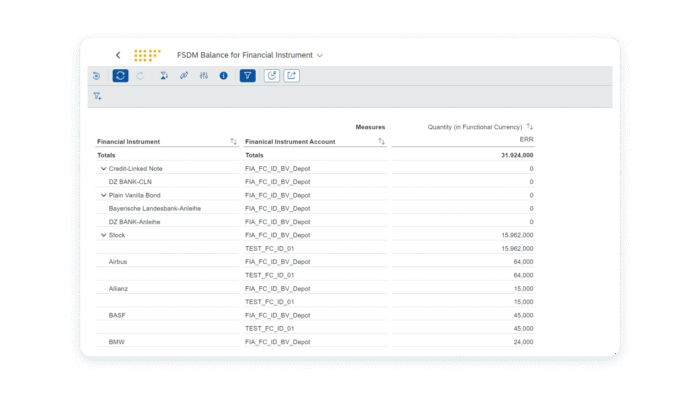

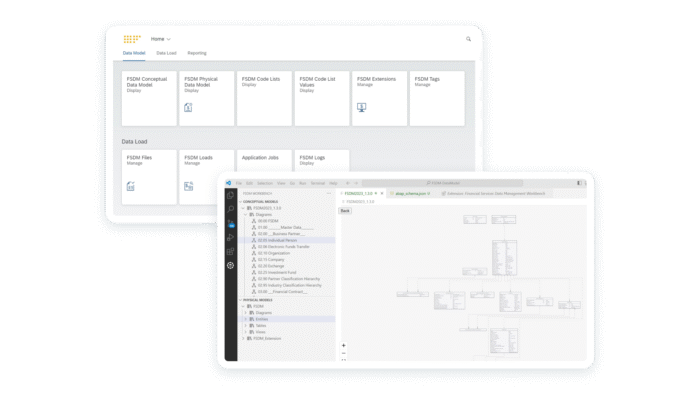

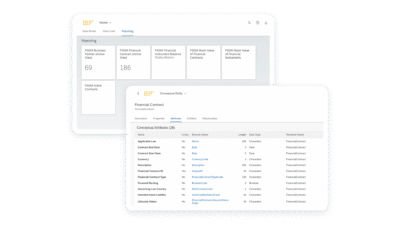

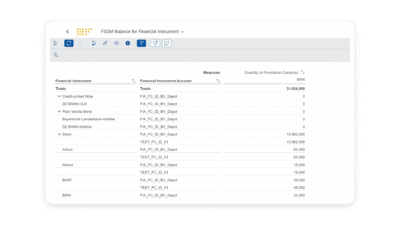

- Financial Services Data Management

Turn data into consistent insights

SAP Fioneer’s Financial Services Data Management (FSDM) was created to solve the data challenges specific to banks. It offers a robust central data management platform designed to integrate, harmonize, and distribute product data and KPIs from various banking systems to analytical solutions for finance, risk and regulatory reporting to unlock value and drive innovation.