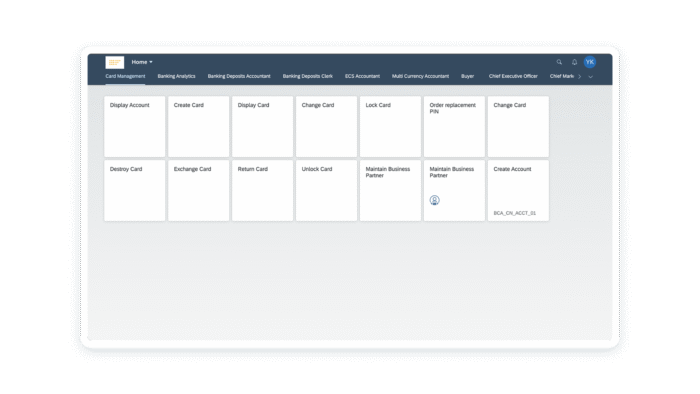

Card management simplified

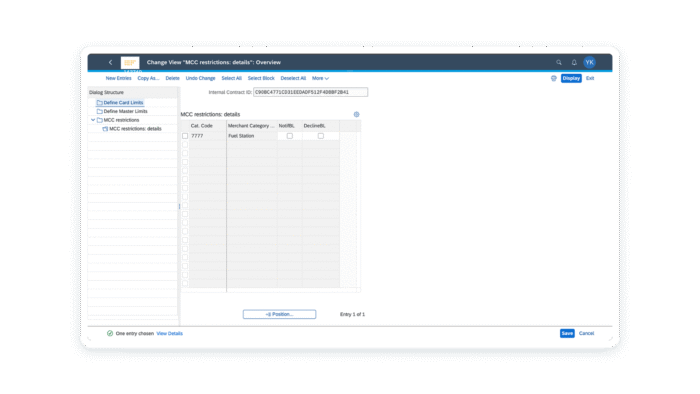

The SAP Fioneer Card Management Solution reduces system complexity and simplifies card processing for any type of card product. From issuing to processing, banks can manage their end-to-end journey, tailor products and empower end-users with complete control and future-ready tools such as token-based payments, Virtual Cards, and compatibility with digital wallets like ApplePay and GooglePay.