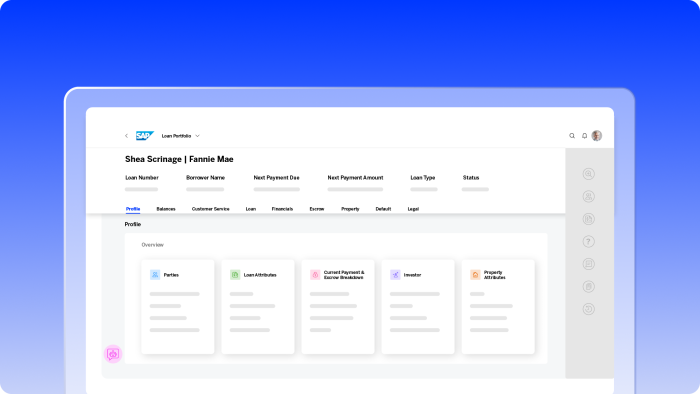

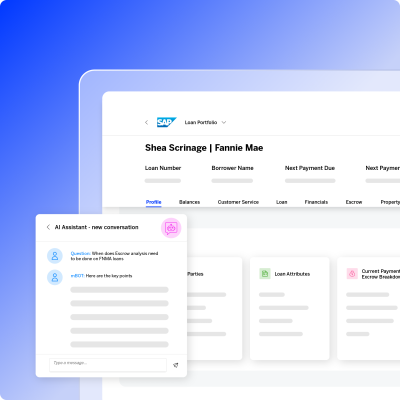

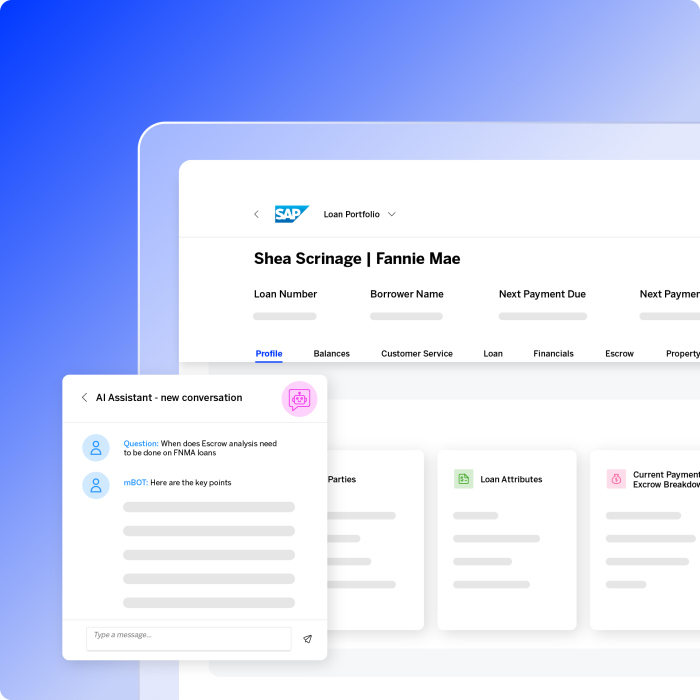

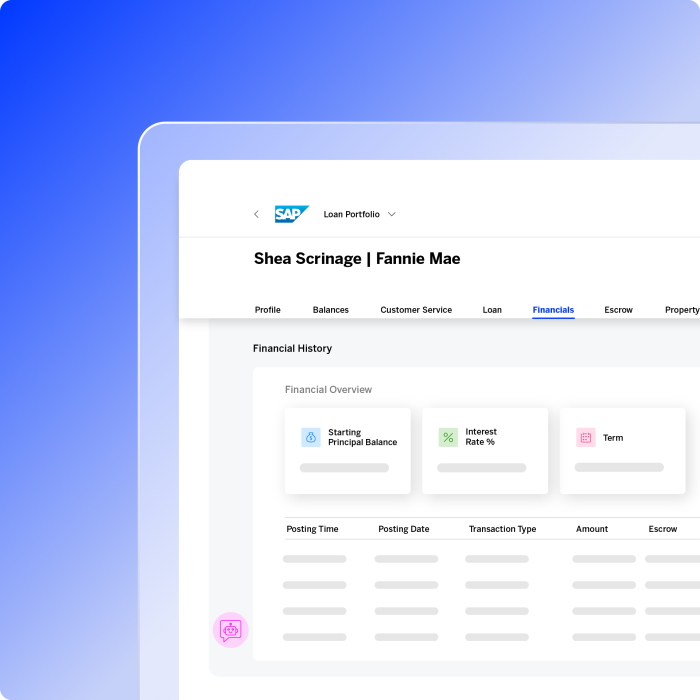

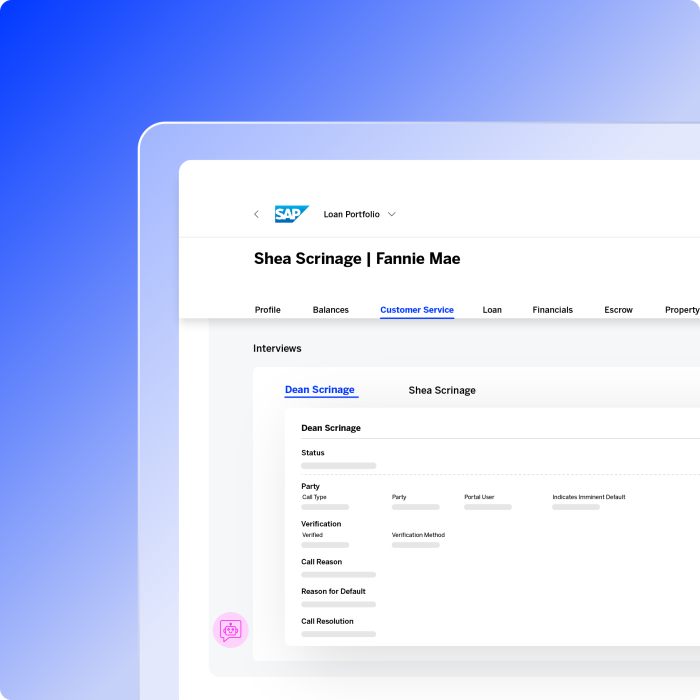

Modern mortgage servicing on an enterprise platform

Cloud for Mortgage is a real-time servicing platform designed to support the full mortgage servicing lifecycle in one integrated system—from loan boarding through REO. Powered by SAP technology, it embeds real-time processing directly into the core, eliminating the need for additional modules and manual handoffs.

With Cloud for Mortgage, a servicer can eliminate these ancillary non-core systems:

- Document Management

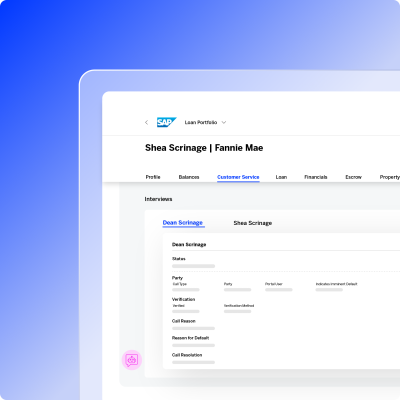

- Customer Service

- Loss Mitigation

- Foreclosure/Bankruptcy

- REO Asset Management

- Investor / Subservicer Portal

ONE system for every servicing department.