The value behind every secured loan

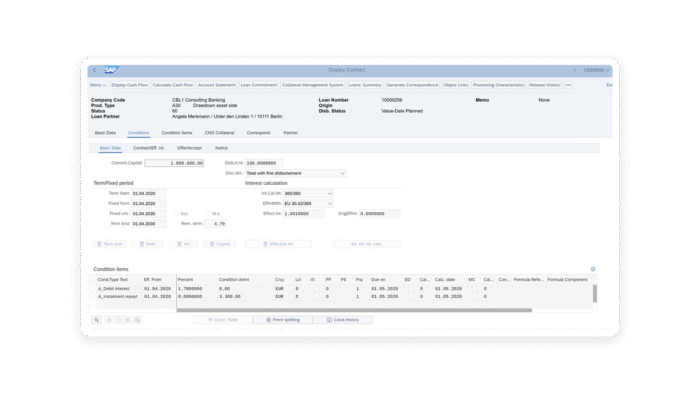

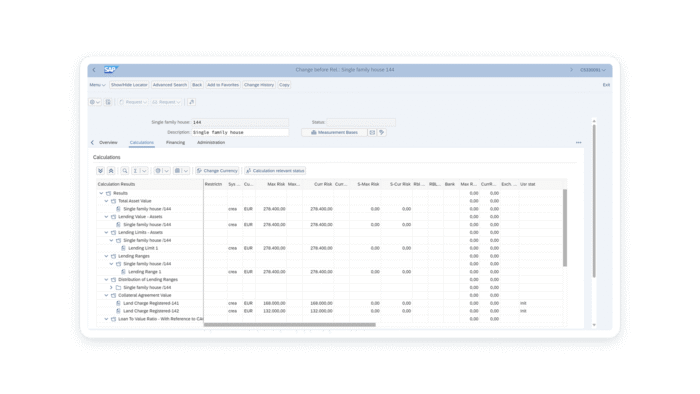

Collateral Management (CMS) is the base for compliant, and scalable collateral operations. With relations between assets, collateral agreements and receivables CMS empowers financial institutions to reduce risk, ensure compliance, and unlock operational efficiency. CMS integrates seamlessly with SAP and third-party systems. Different calculation e.g. LTV, free collaterals, collateral gaps can be used for risk and regulatory reporting.