Unlock your CREF experts’ true potential with our workplace

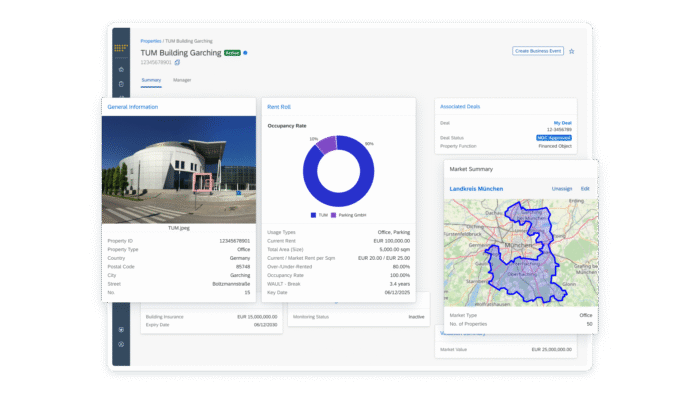

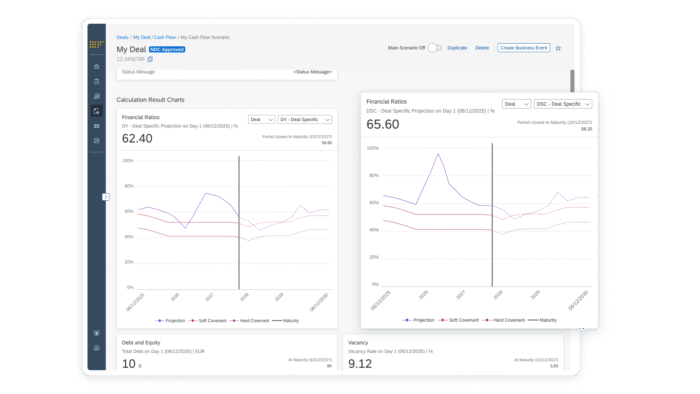

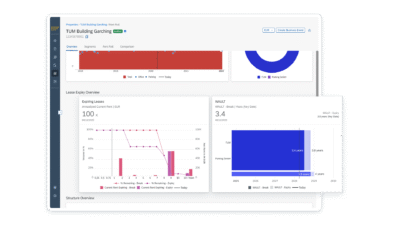

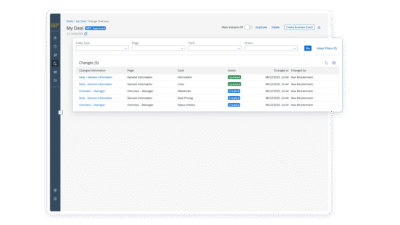

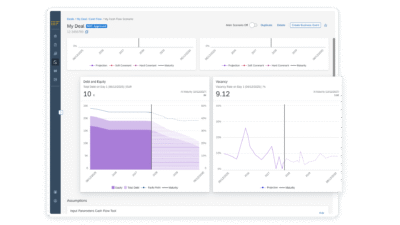

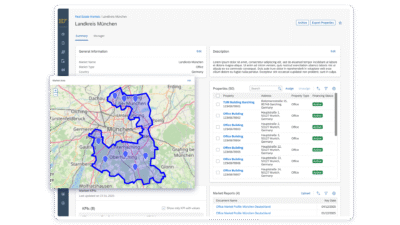

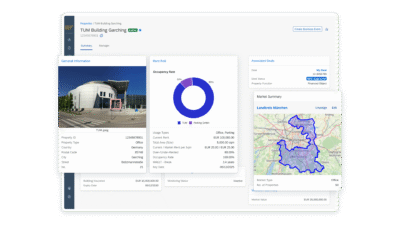

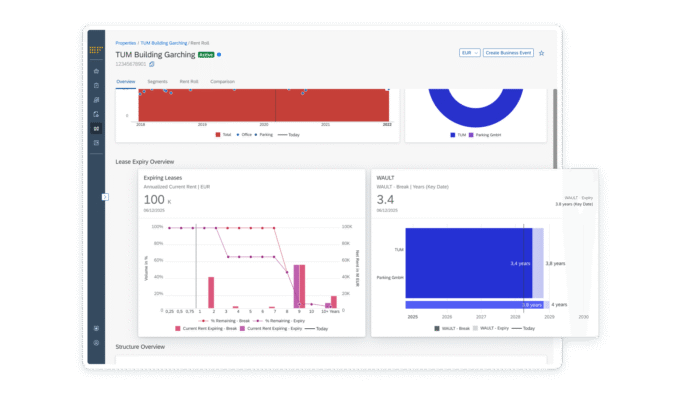

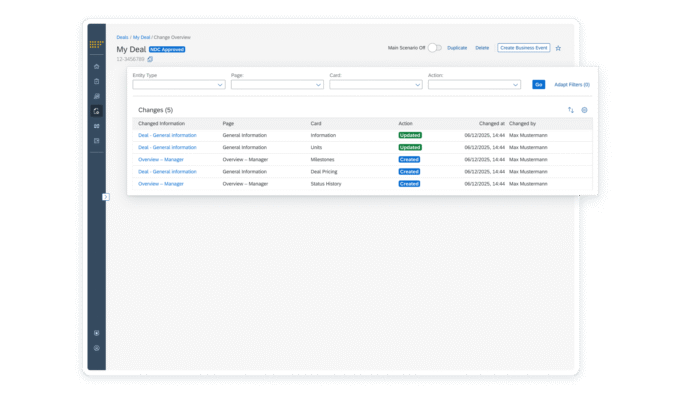

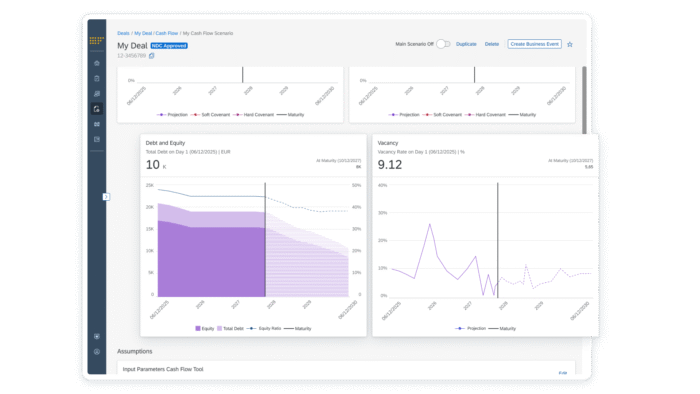

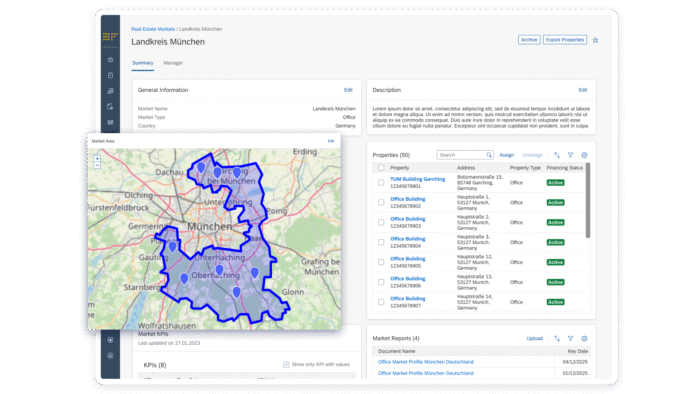

SAP Fioneer’s Credit Workplace enables lending experts to get ahead of CREF challenges of high pressure margins and increasingly volatile markets by leveraging their unique skills on true value-add tasks by unifying multiple manual processes including digital decisioning, KPI tracking and asset management. With strong risk management at its core, you can grow your loan book through profitable deals in a data-driven approach.