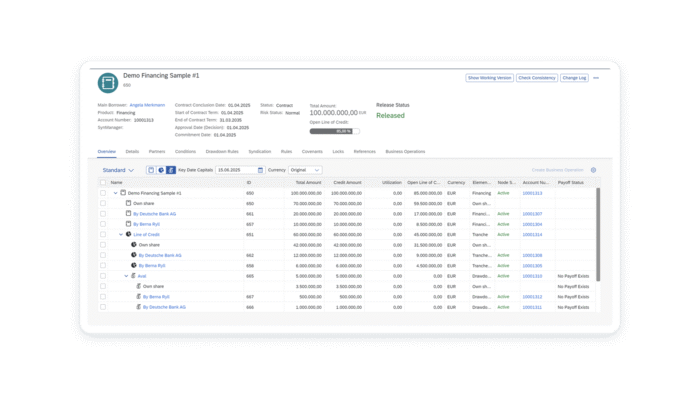

Handle complex financing needs with ease

SAP Fioneer’s Complex Loans streamlines multi-level financings with tranches and drawdowns addressing the intricacies of complex contractual structures and specific business requirements. Built on S/4HANA, our solution provides efficient oversight of the entire life cycle of loans, enhancing operational efficiency and compliance.