Credit Workplace

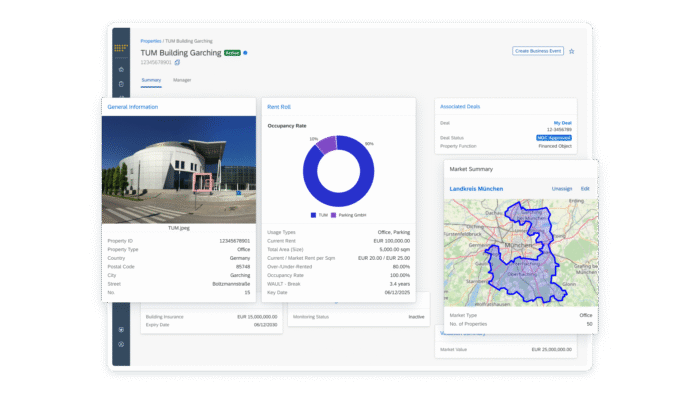

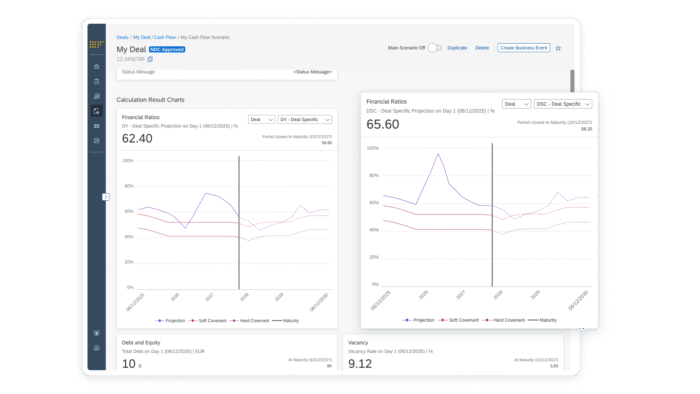

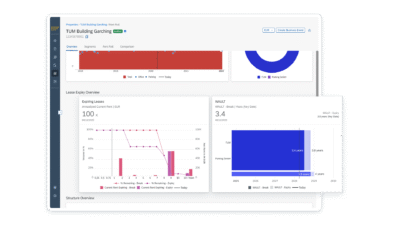

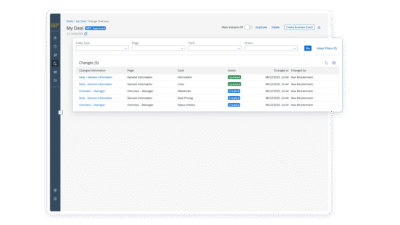

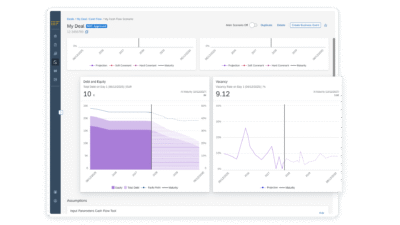

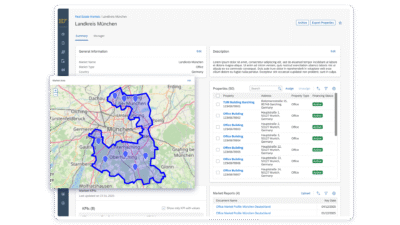

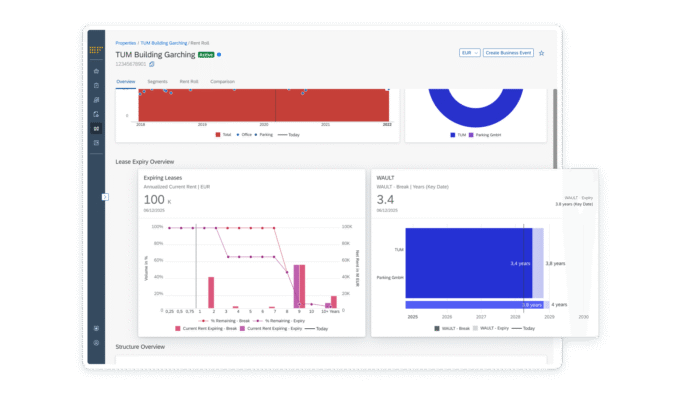

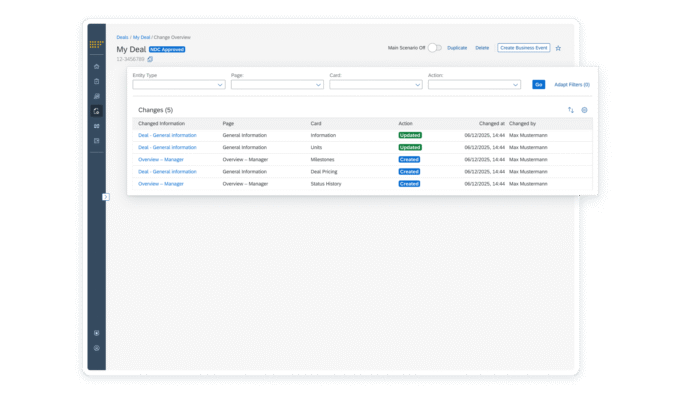

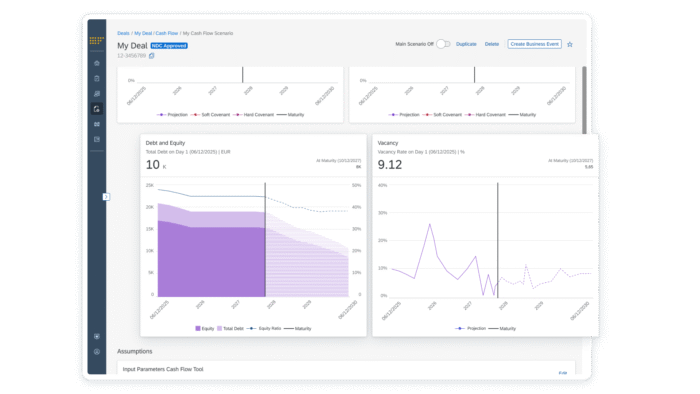

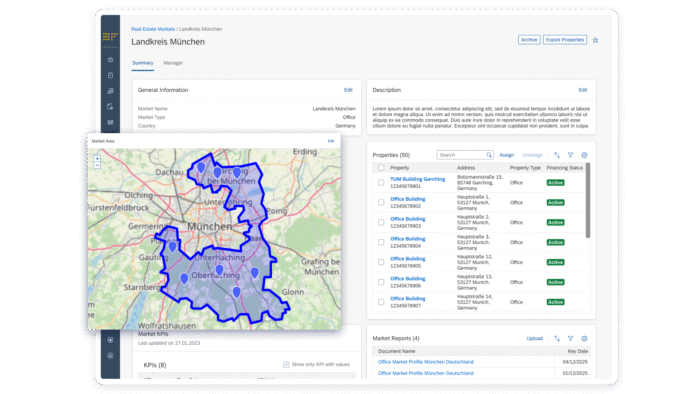

The integrated end-to-end platform centralizes deal, asset and business partner data to streamline credit processes and provide transparency. Through greater automation, CWP empowers teams to operate efficiently, always in line with compliance. Built to integrate seamlessly with SAP Fioneer’s lending stack, Credit Workplace provides the critical first mile in our front-to-back user journey and adds coverage of critical risk management processes for existing business.