Positing keeping for every loan

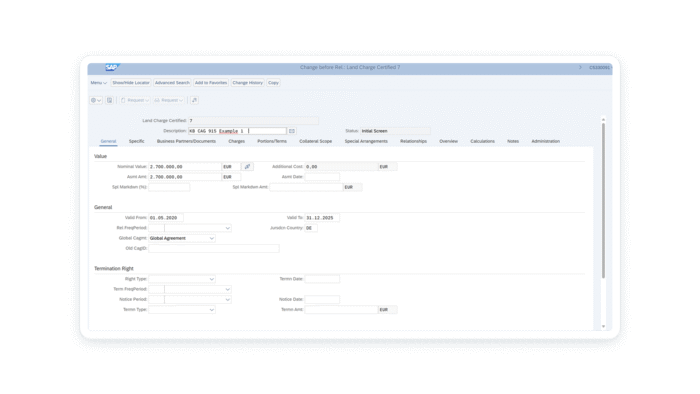

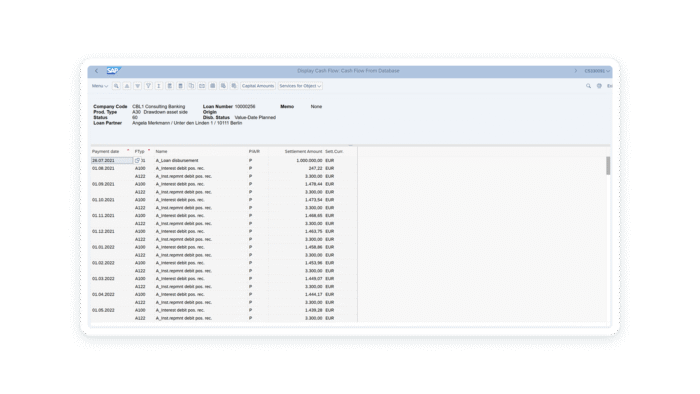

Loans Management (CML) empowers financial institutions to manage all kind of loans, e.g. corporate loans, personal loans, consumer loans, mortgage loans, special loans, policy loans. With a highly flexible framework for the configuration of financial conditions CML supports a bright range of various loan types. CML is real-time integrated with the general ledger and Collateral Management (CMS). CML supports all needed business operations for the complete lifecycle of a loan.