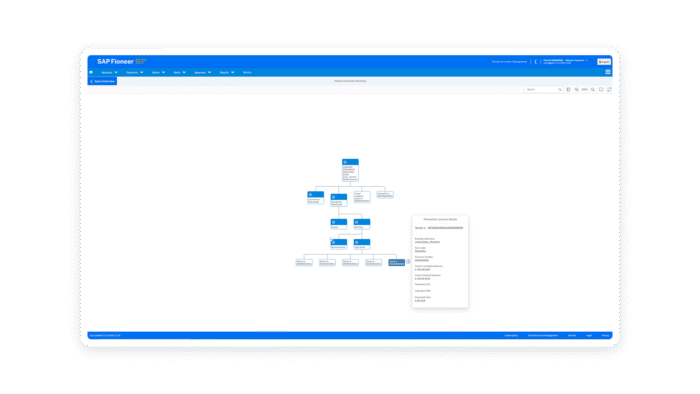

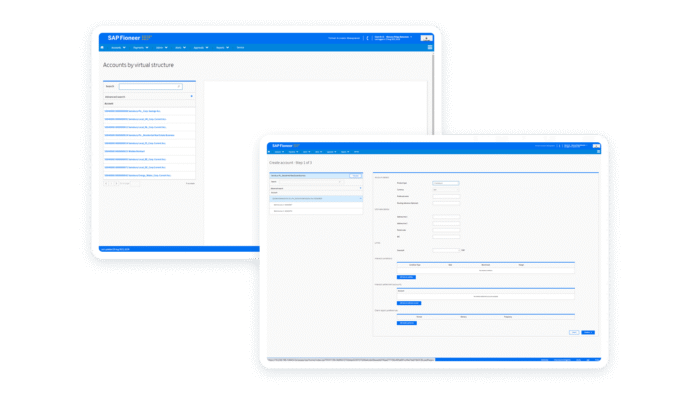

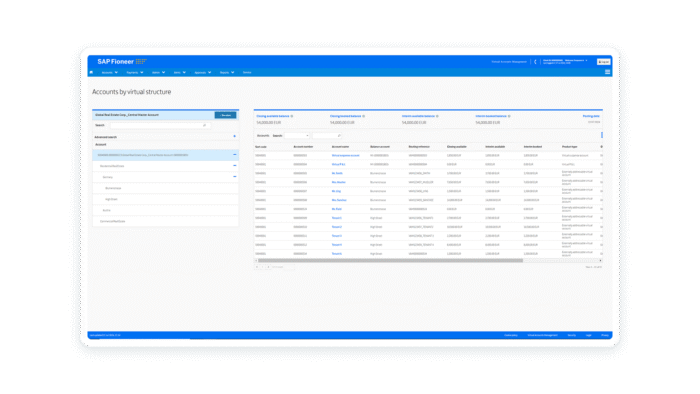

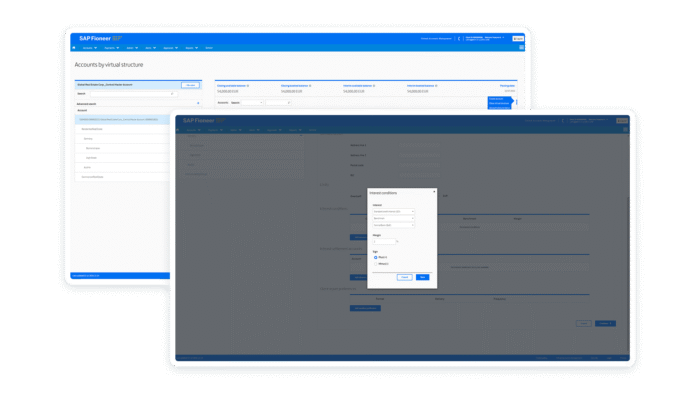

Modern cash management with virtual accounts

Modernize cash management with SAP Fioneer’s Virtual Account Management (VAM). The single solution for corporate, SME, and retail clients to automate reconciliation, gain real-time liquidity insights, and reduce manual work by 60% through high self-service for your customers. Deployable in as little as 120 days, scalable and compliance-ready, virtual accounts helps banks cut costs, grow revenue, and boost customer loyalty.