- Home

- Finance and ESG

- ESG KPI Engine

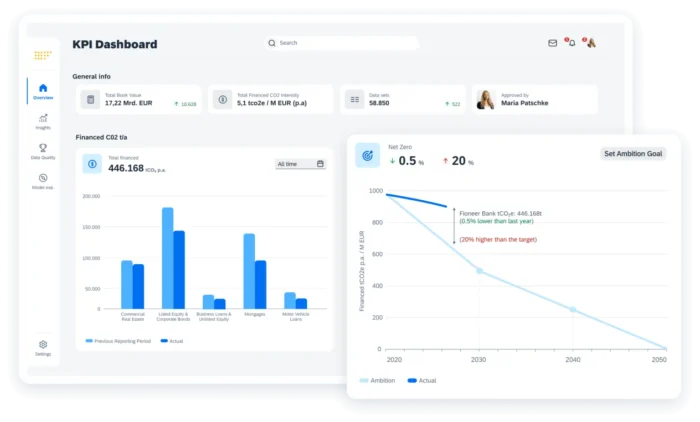

Climate management and ESG reporting for financial products

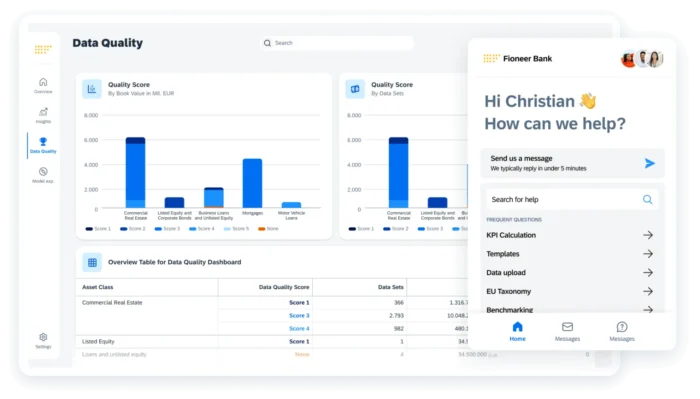

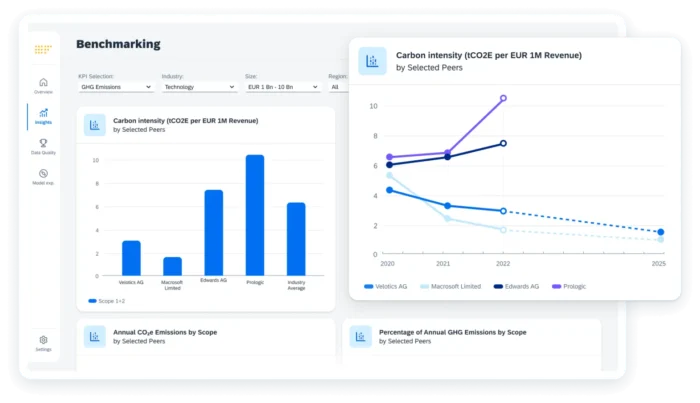

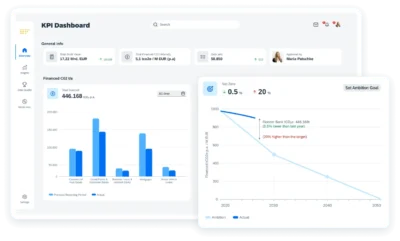

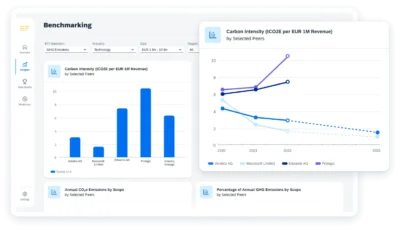

Streamline climate management and ESG compliance with SAP Fioneer’s ESG KPI Engine. Built for finance and risk teams, it automates data collection, calculation, and reporting of climate KPIs. With auditability, real-time dashboards, and seamless integration, it enables institutions to manage portfolios confidently through the climate transition.