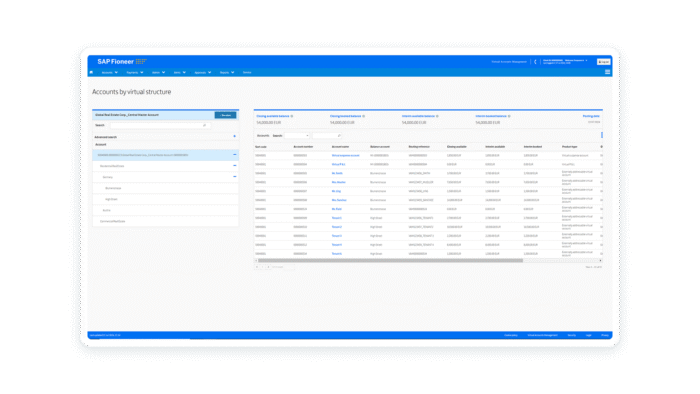

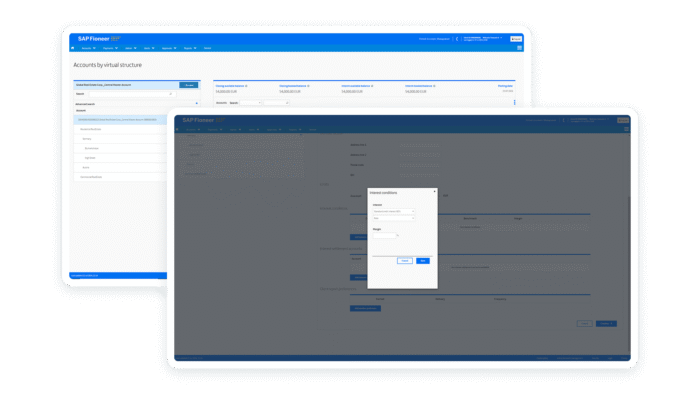

Empower corporate cash management with Virtual Accounts

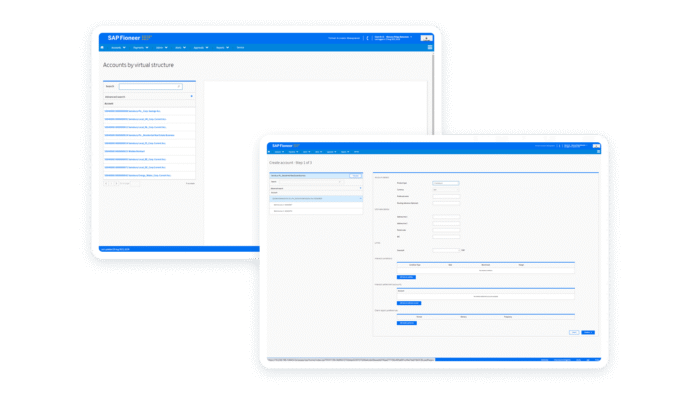

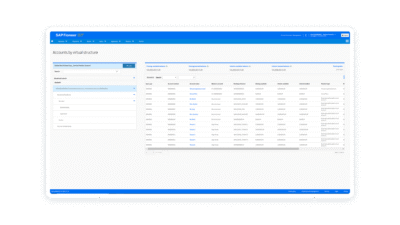

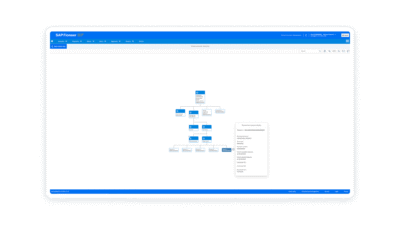

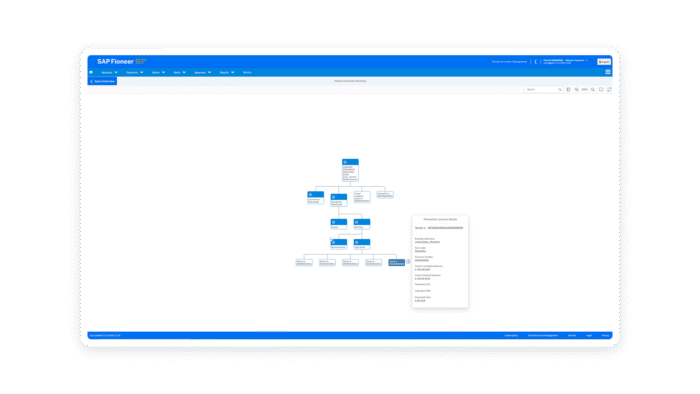

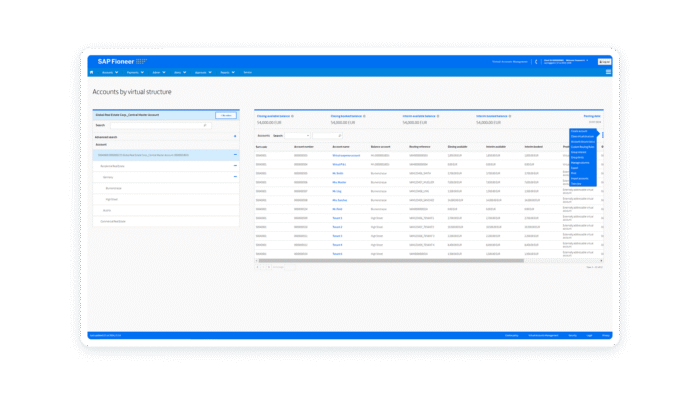

Today’s corporate treasury require reliable real-time cash data and a high level of automation to carry out their extended role as the board’s strategic advisor. SAP Fioneer’s Virtual Account Management (VAM) delivers concentrated cash insights, automated reconciliation and a range of self-service capabilities that can scale and flex as their demands evolve.